Federal Reserve cuts its key rate by a quarter-point but envisions fewer reductions next year

Business

Wednesday’s projections suggest that the policymakers think they may be close to that level

WASHINGTON (AP) — The Federal Reserve cut its key interest rate Wednesday by a quarter-point — its third cut this year — but also signaled that it expects to reduce rates more slowly next year than it previously envisioned, mostly because of still-elevated inflation.

The Fed’s 19 policymakers projected that they will cut their benchmark rate by a quarter-point just twice in 2025, down from their estimate in September of four rate cuts. Their new projections suggest that consumers may not enjoy much lower rates next year for mortgages, auto loans, credit cards and other forms of borrowing.

The central bank’s expectation of just two rate cuts in 2025 rattled Wall Street, sending stock prices plummeting in the worst day for the market in four months. The Dow Jones Industrial Average closed down more than 1,100 points, roughly 2.5%. The Nasdaq composite was hit worse: It sank about 3.5% Wednesday. Higher interest rates can slow business expansion.

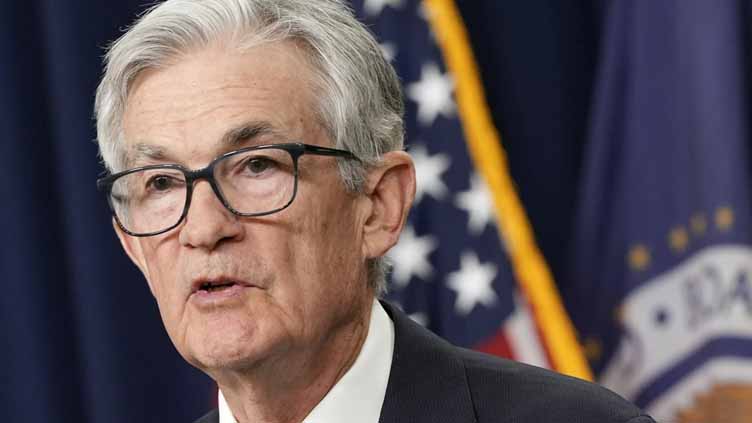

Speaking at a news conference, Chair Jerome Powell underscored that policymakers are slowing their rate reductions as their benchmark rate nears a level that policymakers refer to as “neutral” — the level that is thought to neither spur nor hinder the economy.

Wednesday’s projections suggest that the policymakers think they may be close to that level. Their benchmark rate stands at 4.3% after the latest rate cut, which followed a steep half-point reduction in September and a quarter-point cut last month.

“I think that a slower pace of (rate) cuts really reflects both the higher inflation readings we’ve had this year and the expectations that inflation will be higher” in 2025, Powell said. “We’re closer to the neutral rate, which is another reason to be cautious about further moves.”

Blerina Uruci, chief economist at T. Rowe Price, said the tone of Powell’s news conference was surprisingly “hawkish,” meaning that it seemed to favor maintaining relatively high rates.