Japan election landslide clears path for Takaichi to deliver tax cuts

World

Takaichi's ruling Liberal Democratic Party (LDP) romped to victory in Sunday's poll, helped by a pledge to ease household living costs by suspending the 8% food sales tax for two years

TOKYO (Reuters) – Japanese Prime Minister Sanae Takaichi is set to be pressed on her promised tax cuts and spending plans on Monday after a historic election win was seen heightening the chances of her delivering on stimulus measures that have rattled financial markets.

Takaichi's ruling Liberal Democratic Party (LDP) romped to victory in Sunday's poll, helped by a pledge to ease household living costs by suspending the 8% food sales tax for two years — a move she has described as her "long‑cherished dream."

Investors have baulked at the lack of clarity over how Japan, which has the highest debt burden in the developed world, would fund the proposal. The uncertainty has triggered a selloff in government bonds and pushed the yen towards historic lows against other currencies.

Some analysts had suggested that Takaichi's strong mandate might give her leeway to retreat from the plan, with opposition parties advocating even bolder tax cuts suffering heavy defeats at the ballot box.

But the premier pushed back against that view in a series of brief television interviews as results rolled in on Sunday, saying she would move with speed to realise the LDP's pledge to suspend the levy.

Her solidified grip on power will also keep resistance from fiscal hawks within her own party sidelined, some analysts say. Takaichi is expected to hold her first major post-election press conference later on Monday.

"While there are some within the LDP holding reservations over the idea, the election outcome has heightened the chance of a consumption tax cut," said Ryutaro Kono, chief Japan economist at BNP Paribas.

"The premier has repeatedly said past fiscal policy has been too tight. It's clear she strongly favours overhauling fiscal policy from the current one driven by the finance ministry and fiscal experts within the LDP."

Mindful of the sizeable hole such a move would create in public finances, Takaichi has stressed the tax cut would be temporary and that she remains committed to responsible fiscal management.

Japanese stocks surged, bonds fell and the battered yen recovered some ground on Monday after the LDP's win was seen as enabling decisive action on fiscal stimulus.

Japan is concerned about the rapid moves in foreign exchange markets and is closely monitoring them with a high sense of urgency, top government spokesperson Minoru Kihara told a press conference on Monday.

SOURCE OF FUNDING

The challenge for Takaichi is finding revenue to offset the tax suspension, which would cost about 5 trillion yen ($31.9 billion) a year — roughly equivalent to Japan's annual education budget.

She has ruled out issuing fresh debt but has remained vague on alternative funding sources, saying details would be worked out through cross‑party debates on social welfare and taxation.

Her past hints at tapping non‑tax revenues have drawn attention to Japan's $1.4 trillion foreign exchange reserves, held largely as ammunition for yen intervention.

But dipping too deeply into those reserves could fuel fears that Japan might sell part of its US Treasury holdings — a move likely to unsettle markets and raise concern in Washington.

Prolonged uncertainty over funding risks another bond market sell‑off, analysts warn, with investors already sensitive to Japan's deteriorating fiscal outlook.

A sharp rise in government bond yields would increase the cost of servicing Japan's massive public debt, which at roughly twice the size of its economy is the largest among developed nations.

Worries over fiscal sustainability could also trigger further yen weakness, inflating import prices and broader inflation — potentially diluting the benefit to households from any tax cuts.

Shinichi Ichikawa, senior fellow at Pictet Asset Management Japan, said markets may prove Takaichi's toughest opponent.

"She might have won the public's mandate but not the market's yet," he said. "If concern over worsening finances cause unintended yen falls, that could push up food prices via higher import costs. This may hurt her popularity."

Since taking office in October last year, the dovish premier has already been forced to tone down earlier proposals for larger spending and tax cuts to avoid unsettling markets.

Well aware of the risks of reigniting a backlash, Takaichi appeared notably sombre in television interviews following the election victory.

Asked in one interview why she looked so stern despite what appeared to be a landslide win, and how she would take responsibility if her administration failed to deliver on its pledges, she bristled.

"It's pretty mean to ask that of someone who's about to give it everything," she said from LDP headquarters.

THANKS TRUMP

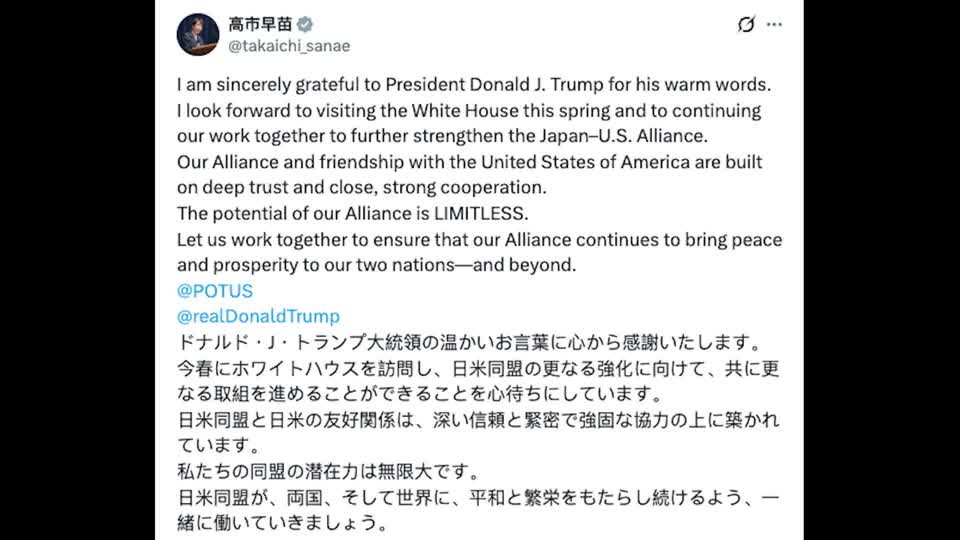

Takaichi thanked United States President Donald Trump for his support ahead of the election in Japan.

"I look forward to visiting the White House this spring and to continuing our work together to further strengthen the Japan-US Alliance," she wrote on X. "Our Alliance and friendship with the United States of America are built on deep trust and close, strong cooperation. The potential of our Alliance is LIMITLESS."

Before the election, Trump endorsed Takaichi and her party, describing her as "someone who deserves powerful recognition for the job she and her Coalition are doing."