Strategy rises as MSCI shelves plans to exclude crypto treasury firms from indexes

Technology

Strategy rises as MSCI shelves plans to exclude crypto treasury firms from indexes

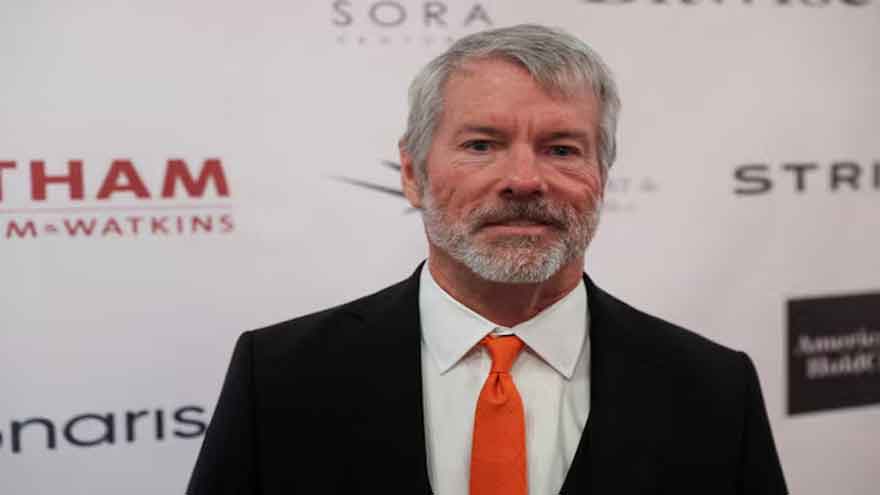

(Reuters) - Shares of billionaire Michael Saylor's Strategy rose in premarket trading on Wednesday, after MSCI dropped a plan to exclude the bitcoin hoarder and other crypto treasury firms from its indexes.

Digital asset treasury companies, often called DATCOs, surged in popularity in 2025 as a wave of firms began holding crypto tokens such as bitcoin and ether as their main treasury assets, lifting prices and giving investors a proxy for direct exposure.

Despite their popularity, the tokens remain prone to sharp price swings and shares have stayed volatile. The accounting treatment is also unsettled, with analysts debating whether these companies should be viewed primarily as holding vehicles or assessed based on their underlying businesses.

"While this decision does not resolve longer-term questions around the index eligibility of DATCOs, it removes a material near-term technical risk for a subset of public equities that function as effective proxies for bitcoin/crypto exposure," said Owen Lau, analyst at Clear Street.

"We believe the most likely middle ground is that MSCI continues to grandfather existing DATCOs already in the Indexes."

Index provider MSCI proposed removing DATCOs from its global benchmarks in the fall, arguing they resemble investment funds, which are excluded from its indexes. The move stoked concerns that other major index providers could follow.

Many such firms countered they are operating companies developing new products, and that MSCI's proposals unfairly single out crypto.

"MSCI intends to open a broader consultation on the treatment of non-operating companies... we suspect exclusion is postponed until later in the year," said Mike O'Rourke, chief market strategist at JonesTrading.

Shares in Strategy, formerly MicroStrategy, surged after it started buying bitcoin in 2020. It was the first among DATCOs, and sparked a crypto treasury frenzy.

It was last up 4.3% before the bell, trimming earlier gains as a fall in bitcoin weighed on crypto-related stocks.