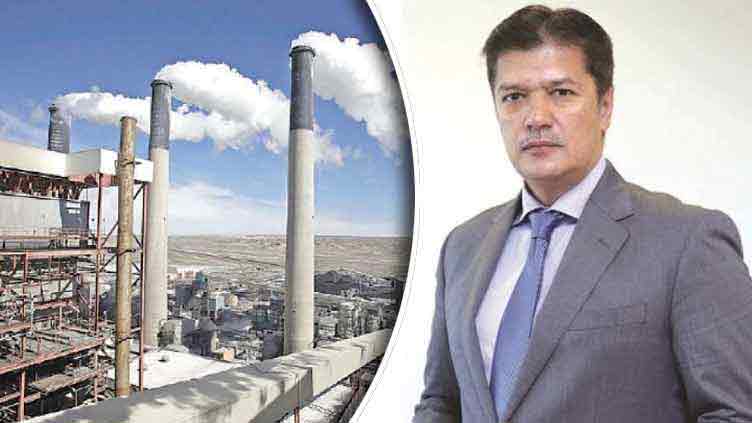

S.M Tanveer calls on govt to review agreements with IPPs

Business

Expresses concern over closure of industrial units due to exorbitant power bills

LAHORE (Web Desk) – United Business Group (UBG) Patron-in-Chief S.M Tanveer has called on the federal government to cancel all the agreements with Independent Power Producers (IPPs) immediately and start sourcing electricity from cheaper alternatives without incurring capacity charges.

In a statement issued on Wednesday, Tanveer expressed grave concern over the closure of various industrial units due to exorbitant electricity tariffs, warning that job losses across the country are a direct consequence.

Tanveer highlighted that the pending Rs2 trillion in capacity payments to IPPs have paralysed the country's economic activities. He urged the government to take decisive action before the prevailing desperation leads to total economic collapse.

He criticised the capacity charges paid to IPPs as unfair, noting that IPPs receive payments even when no electricity is generated or supplied. He pointed out that these capacity charges constitute two-thirds of the total cost, with fuel costs making up the remaining one-third.

“Past investigations revealed IPPs have been enjoying a return on investment exceeding 73 percent in dollar terms, an unusually high rate compared to international standards. Pakistan’s energy sector has been involved in problematic contractual arrangements with IPPs since the Power Policy 1994.

"Initially designed to alleviate the energy crisis by attracting private investment, these contracts have led to an escalating circular debt, which reached Rs2.64 trillion in February 2024."

Also Read: IPP payments reach Rs1,800bn amid mounting Pakistan circular debt

“The incentive structures provided to IPPs, including guarantees indexed to the US dollar, mean that any depreciation of the Pakistani rupee increases returns for IPPs, placing a heavier financial burden on the government and the public. Although the return on equity for IPPs was initially set at 18 percent and later reduced to 12 percent in the Power Policy of 2002, it remains elevated compared to global norms.

"Additionally, cost comparisons with similar projects in other countries suggest that many IPPs were funded through inflated invoicing on capital goods, resulting in no real underlying equity. Consequently, Pakistan is burdened with perpetual returns on ghost equity,” he added.

Moreover, he said, significant misreporting and overbilling by IPPs have exacerbated the issue, as their tariffs are guaranteed under take-or-pay contracts protected by international law.

For instance, the actual oil consumption of several oil-based plants is less than what is billed by the IPPs. Attempts to audit these discrepancies have often been obstructed by IPPs through legal means such as stay orders.

Similarly, operation and maintenance costs are overstated; where the actual expense is Rs500 million, it is billed at Rs1.5 billion per annum, he maintained.

Tanveer feared that the recent surge in electricity rates could trigger civil unrest and discontent among the business community if no timely action is taken by the government. He called for a comprehensive review of IPP agreements, price re-evaluation within legal bounds, and improved oversight to prevent over-invoicing.

He also stressed the importance of examining the energy infrastructure for clauses related to misinformation and fraud.

Tanveer expressed hope that the federal government would soon devise a solid strategy to deal with the IPPs and ensure affordable electricity prices for the industry at large in the national interest.