China credit warning is well-timed plea for action

Business

China credit warning is well-timed plea for action

HONG KONG (Reuters ) - It’s a long-running criticism that credit rating agencies are too often too slow to spot a crisis. So their detractors will be unsurprised that Moody’s is only now issuing China with a downgrade warning despite how long the country’s property woes and indebted local governments have vexed investors. Nor will it shock them that the handy summary of the problems contains little new information. The American firm’s otherwise tardy-looking action is well-timed in one key respect: it landed just ahead of a slew of important planning sessions where Beijing will set the policy agenda for the coming year.

So far, the official reaction has been quite muted, with a Ministry of Finance official saying China is “disappointed” with the move and calling the rater’s concerns about growth and fiscal sustainability “unwarranted”, per the Xinhua News Agency. Of course, it’s just an outlook change, not a full downgrade like the one Moody’s instigated in 2017 that prompted a fierce response from Beijing. And it helps that the company outlined the country’s strengths, from its high savings rate to its growth potential – and that it already hit the U.S. with the same warning last month.

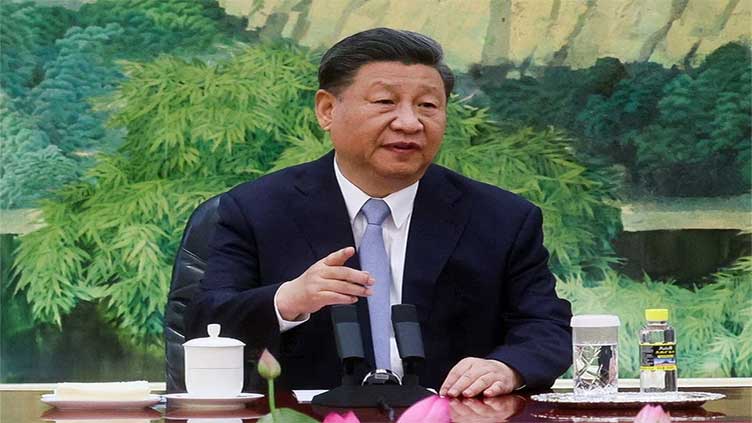

Moreover, by highlighting issues that need addressing, Moody’s is sending a reminder of the need for responsible economic management. President Xi Jinping’s government, for example, has pledged to formulate “a basket of plans” to resolve local government debt issues, but policies rolled out so far are piecemeal and pose, per the rating agency, “broad downside risks” to its economy. Instead, it argues for a “comprehensive and credible plan” to fix the problem that only carries “moderate costs” for the public sector.

Granted, that might sound like trying to pull a rabbit out of a hat, but it starts with acknowledging the scale of the problem. The ministry reiterated on Tuesday that government debt totaled 61 trillion yuan ($8.5 trillion), around half the country’s 2022 GDP and thus below the 60% red line drawn by international standards. But that doesn’t include off-balance-sheet debt, a figure the ministry has not updated since conducting a year-long, nationwide audit in 2011. Back then it stood at 10.7 trillion yuan. It has since mushroomed to 92 trillion yuan according to the International Monetary Fund.

Topping that with a credible, official figure is just one of the actions China’s policymakers ought to pursue to instill faith that its decisions are responsible ones.

CONTEXT NEWS

Moody's on Dec. 5 lowered its outlook on China's government credit ratings to negative from stable, saying the cost to bail out local governments and control its property crisis would weigh on the world's No. 2 economy. The rating agency did, though, reaffirm the country’s A1 long-term local and foreign currency issuer and senior unsecured credit ratings.

China is “disappointed” with the outlook decision, an official from the Ministry of Finance told Xinhua News Agency, saying the rating agency’s concerns about China’s growth and fiscal sustainability are unwarranted.