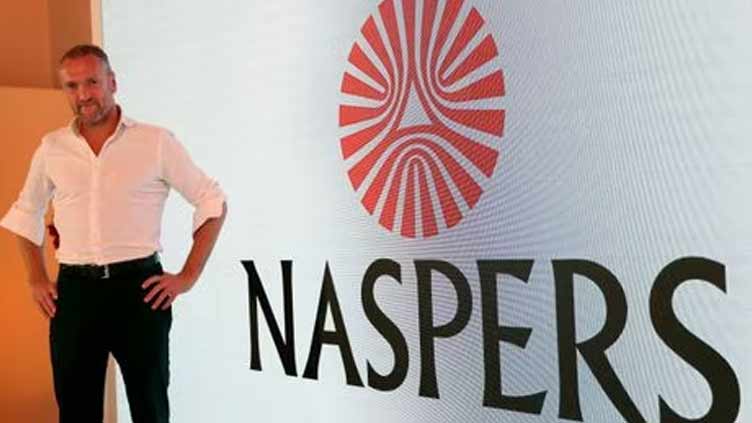

Naspers and Prosus CEO steps down M&A chief Tu takes the helm

Technology

The companies did not give a reason for Van Dijk's departure

JOHANNESBURG/AMSTERDAM (Reuters) - Bob van Dijk has stepped down as the long-time CEO of Dutch technology investor Prosus (PRX.AS) and its South African parent company Naspers, with M&A chief Ervin Tu taking both positions on an interim basis.

The companies, whose main asset is Prosus's 26% stake in Chinese tech giant Tencent (0700.HK) worth about $100 billion, did not give a reason for Van Dijk's departure. But it coincides with a restructuring in Naspers/Prosus relations, with Prosus no longer holding shares in Naspers.

Tu, a former manager at SoftBank's (9434.T) Vision Fund, takes over Prosus's investments in consumer internet businesses ranging from food delivery and payments to online marketplaces and educational software. Analysts said he was the most likely candidate to succeed Van Dijk permanently.

At 0910 GMT, Prosus shares were trading down 0.9% in Amsterdam, while Naspers' shares were 1.5% lower in Johannesburg. Tencent shares closed down 1.6% in China.

On a call with investors, Naspers chairman Koos Bekker underlined the companies had no plans to divest from Tencent, which he called "one of the best tech companies in the world."

A source close to the companies said Van Dijk's exit came at a natural time after nearly a decade at the helm of Naspers, almost double the time most CEOs spend at FTSE 100 companies.

Van Dijk oversaw Prosus's 2019 IPO and the company's stock boomed during the COVID-19 pandemic. However, its shares fell along with technology valuations in the post-pandemic bust, and Van Dijk struggled to reduce a discount in the value of Prosus and Naspers versus Tencent.

Van Dijk, who has led Naspers since 2014 and Prosus since 2019, has agreed to remain as a consultant until Sept. 30, 2024, the companies said in a statement.

Naspers owns 43% of Prosus and has a 72% voting interest.

MORE IPOS

Tu said Prosus was working on "multiple situations" to unlock value, including possibly seeking stock market listings for some investments.

"There are a number of businesses that will be listable. And we anticipate they will be well received by the markets," he told Reuters in an interview.

But he cautioned shareholders would have to wait.

"Those types of situations are not things where you snap your fingers and suddenly something happens, they take time," he said.

He said Prosus would continue to pursue share buybacks to close a valuation gap between Naspers/Prosus and Tencent.