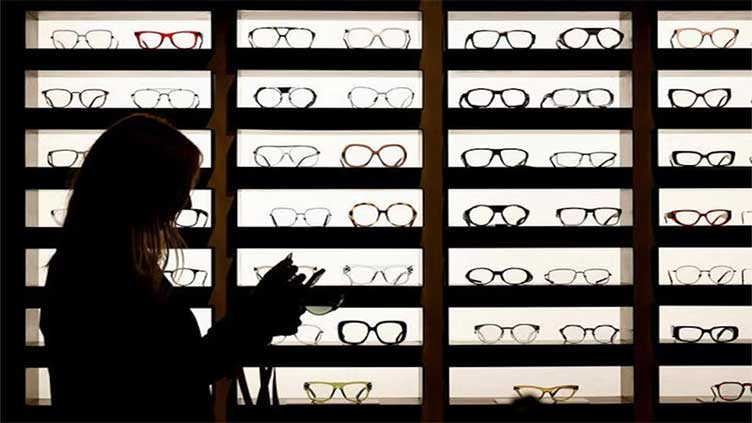

Ray-Ban maker EssilorLuxottica slams 'grab bag' lawsuits claiming eyewear monopoly

Business

The company told the district judge that plaintiffs had not presented enough facts to justify claims

(Reuters) – Eyewear giant EssilorLuxottica has asked a US judge to throw out what it called “misguided” consumer lawsuits accusing the Ray-Ban maker of monopolizing markets for designer frames and prescription lenses, causing customers to pay higher prices.

In a court filing, EssilorLuxottica on Wednesday told US District Judge Mary Kay Vyskocil in Manhattan that the consumer plaintiffs had not presented enough facts to justify their claims that the company and affiliated entities were violating US antitrust law.

A series of lawsuits first filed last year and later consolidated in Manhattan alleged EssilorLuxottica used serial acquisitions of rivals and restrictive sales and distribution agreements to unlawfully dominate markets for eye products.

“Their claims amount to nothing more than a contention that building a successful company over many decades is unlawful,” EssilorLuxottica’s court filing said. It added: “That is not an antitrust violation; it is good business.”

Lawyers for the plaintiffs did not immediately respond to requests for comment, and neither did EssilorLuxottica and its attorneys.

Italian eyewear giant Luxottica in 2018 merged with French lens maker Essilor in a $58 billion deal, forming EssilorLuxottica.

EssilorLuxottica owns major retail outlets including LensCrafters, Sunglasses Hut and For Eyes, and also popular eyewear brands such as Persol, Oliver Peoples, and Oakley.

Two related lawsuits seek class action status for buyers who purchased products from EssilorLuxottica and related business entities and who indirectly bought items through third-parties such as optometrists.

The plaintiffs said EssilorLuxottica had formed a web of anticompetitive agreements providing consumers only “an illusion of choice in a competition-free ecosystem.”

EssilorLuxottica captured more than half of the nearly $8.5 billion US retail market for premium eyewear, the consumers alleged.

In its bid to dismiss the lawsuit, EssilorLuxottica said it and its affiliated companies operated in a highly competitive industry, and that the plaintiffs’ “grab bag” of antitrust claims failed to allege that the company was excluding potential rivals.

New market entrants like Warby Parker “have quickly built substantial eyewear businesses under their own new brands,” EssilorLuxottica said.