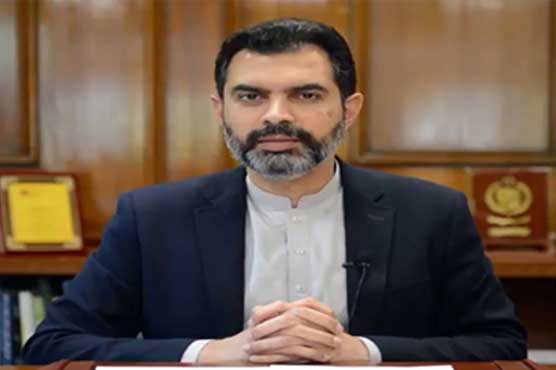

Sustainable growth is our goal: Reza Baqir

SBP Governor Reza Bqir said that our growth will be 5 percent this year

LAHORE (Dunya News) – State Bank of Pakistan (SBP) Governor Dr Reza Baqir said on Friday that with the news of Saudi aid, our exchange rate has come down from Rs 175 to Rs 170 while the exporters have started devaluing the dollar after the exchange rate has come down.

Speaking exclusively in Dunya News program “Dunya with Kamran Khan Kay Sath” after the SBP increased the basic interest rate by 1.50 percent, he said that steps are being taken to reduce inflation.

The SBP Governor said that our growth will be 5 percent this year, adding that our economic growth is accelerating, this year the economic growth target has been set at 5%.

"Inflation is accelerating, our target is steady growth, adding that inflation and current account deficit have increased in the last two months, it was higher than our previous expectations," he added.

The SBP Governor went on to say that they want to reduce excessive imports, while inflation is 9 percent and interest rate is 8.75 percent and the our measures have considerably reduced the current account deficit.

Interest Rate

Earlier today, the State Bank of Pakistan (SBP) had announced an increase of 150 basis points to 8.75 percent in its benchmark policy rate in a bid to contain runaway inflation.

In its Friday’s meeting, the Monetary Policy Committee (MPC) decided to raise the policy rate by 150 basis points to 8.75 percent. This reflected the MPC’s view that since the last meeting, risks related to inflation and the balance of payments have increased while the outlook for growth has continued to improve.

The heightened risks related to inflation and balance of payments stem from both global and domestic factors. Across the world, price pressures from Covid-induced disruptions to supply chains and higher energy prices are proving to be larger and longer-lasting than previously anticipated. In response, central banks have generally begun to tighten monetary policy to keep inflation expectations anchored. In Pakistan too, high import prices have contributed to higher-than-expected CPI, SPI, and core inflation outturns.

At the same time, there are also emerging signs of demand-side pressures on inflation, and inflation expectations of businesses have risen on account of further upside risks from domestic administered prices.

With respect to the balance of payments, the current account deficits in September and October have been larger than anticipated, reflecting both rising oil and commodity prices and buoyant domestic demand. The burden of adjusting to these external pressures has largely fallen on the rupee.

As a result of these developments, the balance of risks has shifted away from growth and toward inflation and the current account faster than expected. Accordingly, the MPC was of the view that there is now a need to proceed faster to normalize monetary policy to counter inflationary pressures and preserve stability with growth. Today’s rate increase is a material move in this direction. Looking ahead, the MPC reiterated that the end goal of mildly positive real interest rates remains unchanged and, given today’s move, expects to take measured steps to that end.

In reaching its decision, the MPC considered key trends and prospects in the real, external, and fiscal sectors, and the resulting outlook for monetary conditions and inflation.