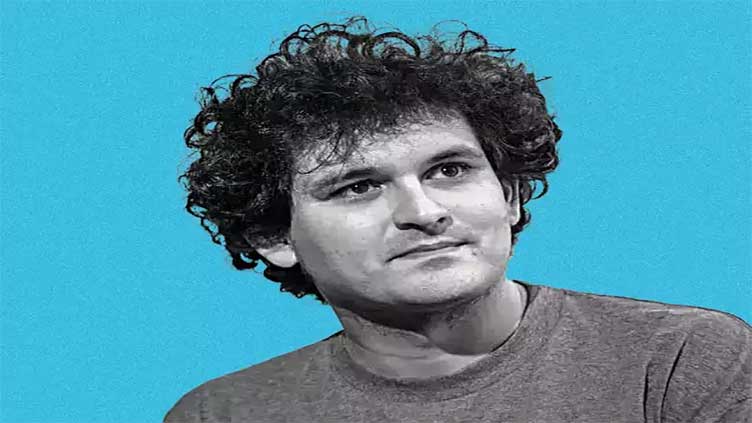

FTX founder keeps talking, ignoring typical legal strategy

Technology

FTX founder keeps talking, ignoring typical legal strategy

NEW YORK (AP) - For federal prosecutors, Sam Bankman-Fried could be the gift that keeps on giving.

After the November collapse of FTX, the cryptocurrency exchange he founded in 2019, Bankman-Fried unexpectedly gave a series of interviews intended to present his version of events. He was indicted in December and charged with perpetrating one of the biggest frauds in U.S. history — and he’s still talking, either in person or on the internet.

The atypical chattiness for a criminal defendant is likely causing Bankman-Fried’s attorneys to scratch their heads, or worse. Prosecutors can use any statements, tweets or other communications against him at his trial, which is scheduled for October.

“Prosecutors love when defendants shoot their mouths off,” said Daniel R. Alonso, a former federal prosecutor who is now a white-collar criminal defence attorney. If Bankman-Fried’s public comments before trial can be proven false during the trial, it may undermine his credibility with a jury, he said.

Bankman-Fried’s most immediate concern, however, is a recent private communication. Prosecutors say he sent an encrypted message over the Signal texting app on Jan. 15 to the general counsel of FTX US, a likely witness for the government. Bankman-Fried will be back in a New York court Thursday, where a judge could impose new bail restrictions because of what could be seen as an attempt to influence a witness.

Before its collapse, FTX was the world’s second-largest crypto exchange and Bankman-Fried, 30, was its CEO and a billionaire several times over, at least on paper. Celebrities and politicians alike vouched for FTX and its founder, and Bankman-Fried was considered a leading figure in the crypto world.

However, the broad collapse of cryptocurrencies last year caused severe financial stress for numerous companies in the crypto universe, from lenders to exchanges to firms focused on investing in digital assets. FTX sought bankruptcy protection in November after customers pulled out their money in the crypto equivalent of a bank run.

Federal prosecutors have said Bankman-Fried devised “a scheme and artifice to defraud” FTX’s customers and investors right from FTX’s inception. They say he illegally diverted their money to cover expenses, debts and risky trades at Alameda Research, the crypto hedge fund he started in 2017, and to make lavish real estate purchases and large political donations.

In interviews and Twitter posts, Bankman-Fried has said he never intended to defraud anyone. He’s maintained that running FTX took up all his time and that he was unaware of the financial problems at the hedge fund until it was too late.

Those assertions are likely to be refuted by one of the government’s key witnesses. Caroline Ellison, the former CEO of Alameda, has agreed to plead guilty for her role in FTX’s collapse and to testify against Bankman-Fried. In a plea hearing in December, Ellison said she knew FTX had used billions in customer funds to make loans to Alameda and agreed with Bankman-Fried and others to take steps to conceal the nature of the loans.

Gary Wang, who co-founded FTX with Bankman-Fried, also struck a deal for cooperation. At his own plea hearing, Wang said that he made changes to the computer code to enable FTX customer funds to be transferred to Alameda.

Another claim made often by Bankman-Fried is that he’s trying to help recover funds for FTX customers, but that FTX’s new management has cut him off and has taken steps, including filing for bankruptcy protection that could inhibit customers from getting their money back.

For instance, Bankman-Fried says that when FTX collapsed, outside parties had made funding offers totaling billions of dollars, and if given a few weeks the company could have raised enough money “to make customers substantially whole.” Instead, it was “strong-armed” into filing for bankruptcy protection by its main law firm, Sullivan & Cromwell, a claim the firm denies.

Bankman-Fried has also frequently taken issue with decisions made by FTX’s new CEO, John Ray. Bankman-Fried has often claimed that FTX’s U.S. operation, which was considerably smaller than the international operations, was solvent at the time of the bankruptcy filing, a contention that Ray disputes.

“I’m still waiting for him to finally admit that FTX US is solvent and give customers their money back,” Bankman-Fried tweeted on Jan. 19.

Bankman-Fried was scheduled to testify under oath in front of Congress in December with Ray, but that appearance was cancelled because of his arrest in the Bahamas, where FTX is based.

“The real risk Bankman-Fried runs in making public comments ‘explaining’ what happened is they could be seen as continuing efforts to mislead investors by regulators and prosecutors,” said Jeff Linehan, a former prosecutor in the financial crimes division of the New York State Attorney General’s Office. Linehan is now a criminal defence attorney.

Bankman-Fried’s comments at the time of FTX’s collapse could also come back to haunt him. On Nov. 7, as customers furiously demanded their money back, he tweeted “FTX is fine. Assets are fine.” He deleted the tweet the next day. On Nov. 11, FTX filed Chapter 11.

Through a spokesman, Bankman-Fried declined to comment for this article.

Some defendants will go through their entire legal ordeal without saying anything that isn’t first cleared by their attorneys. Even putting defendants on the witness stand at trial has long been seen by defense attorneys as a last-resort option because it opens them up to interrogation by prosecutors and often does more harm than good.

“As the prosecution prepares their case, it’s really important to figure out what the defense’s strategy could be, and a defence wants to keep that strategy under wraps as much as possible,” said Alonso, the former federal prosecutor.

Bankman-Fried faces the possibility of decades in prison if convicted on all counts. Even if he were to agree to a plea bargain, a judge would have full discretion on what sentence to impose. If the judge does not believe Bankman-Fried is truly sorry for his actions, based partly on his public statements, he could ignore the prosecution’s recommendations and impose a stricter sentence, legal experts say.

Before FTX collapsed, Bankman-Fried had built up a gigantic public persona. He spoke often to reporters, testified in front of Congress, and appeared at conferences to advocate for cryptocurrencies and his firm. He gave millions of dollars to political candidates and advocated for charitable causes such as food issues in the Bahamas. It could be difficult to give up that sort of public influence.

“Some people simply can’t help themselves,” Alonso said.