EPBD demands bold monetary action as regional competitors surge ahead

Business

It demands immediate rate reduction to 6pc to restore industrial viability, economic growth

LAHORE (Dunya News) - Ahead of the upcoming Monetary Policy Committee meeting on July 30, Pakistan's businesses face an existential threat from unsustainable monetary policy.

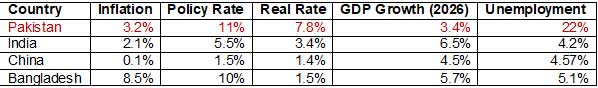

The anticipated minimal 0.5%-1% rate reduction fails to address the fundamental crisis destroying Pakistan's industrial competitiveness and fiscal stability. With inflation at 3.2%, the current 11% policy rate imposes a crippling 7.8% real cost of capital on Pakistani businesses. EPBD demands an immediate rate reduction to 6pc to restore industrial viability and economic growth.

Pakistani businesses operate under impossible conditions compared to regional competitors. While regional manufacturers access capital at an average of 5.5% policy rates, Pakistani industry faces 11%—double the regional average.

This disparity, combined with energy costs of 12-14 cents per kWh versus regional levels of 5-9 cents, creates insurmountable competitive disadvantages.

Pakistan's real interest rate of 7.8% represents the highest burden among regional economies, more than double India's 3.4% and over five times China's 1.4%. This excessive real cost of capital makes Pakistani business investments fundamentally uncompetitive.

While India's supportive 3.4% real rate enables projected 6.5% growth in 2026, Pakistan's punitive 7.8% real rate constrains growth to just 3.4%—nearly half of India's performance.

The growth differential has direct consequences for employment. Pakistan's 22% unemployment reflects businesses unable to expand operations under prohibitive financing costs, while India maintains 4.2% unemployment through policies that enable business growth.

Manufacturing capacity sits idle while competitors with supportive monetary policies capture global markets. Pakistan's export-to-GDP ratio has stagnated at 10.48% compared to India's 21.85% and Vietnam's 87.18%.

The State Bank's reserve accumulation from $9.06 billion (20th June 2025) to $14.46 billion (as of 18th July 2025) relies entirely on $3.1 billion in commercial borrowing and $500 million in multilateral funding—not export earnings or business growth.

This artificial stability masks the underlying deterioration of Pakistan's productive economy.

FISCAL REVENUE TRAP

Pakistan's tax collection strategy contradicts its monetary policy. The government collected PKR 11.9 trillion in FY25 against a target of PKR 12.9 trillion and now expects PKR 14.1 trillion in FY26—an 18% increase. This target becomes impossible when monetary policy actively suppresses the business activity that generates tax revenue.

High interest rates systematically reduce corporate profitability, limit business expansion, constrain employment growth, and diminish consumer spending—all primary sources of government revenue.

Pakistani businesses cannot generate the profits necessary for robust tax payments while servicing 11% debt costs. The policy framework ensures continued fiscal shortfalls while demanding impossible revenue growth.

State Bank officials persistently cite import surge fears to justify maintaining high rates, yet historical evidence proves this reasoning fundamentally flawed. The 2017-18 trade deficit surge to $37 billion occurred despite restrictive monetary policy, driven by CPEC infrastructure requirements—crude oil imports increased $1.4 billion, LNG imports rose $1.1 billion, and coal imports jumped $408 million. Similarly, the 2021-22 deficit expansion to $47 billion stemmed entirely from external shocks: COVID-19 vaccine imports alone increased $2.7 billion, while energy crisis imports surged $8.1 billion across motor spirit, crude oil, and LNG as global commodity prices spiked following geopolitical tensions.

Pakistan's import requirements are driven by energy needs, infrastructure development, health emergencies, and global price shocks—none of which respond to domestic interest rate adjustments. High rates contributed nothing to controlling these structural imports while devastating the productive sectors that could have generated export revenue to balance trade accounts.

The policy destroys export capacity while failing to address the actual drivers of trade deficits

Meanwhile, Pakistan's industrial base erodes as businesses postpone investments, reduce operations, and eliminate jobs due to unaffordable credit. The real economic damage from restrictive monetary policy far exceeds any theoretical import control benefits.

REQUIRED POLICY ACTION

Reducing policy rates to 6% would restore competitive financing for Pakistani businesses, enable industrial expansion necessary for employment creation, support export growth through affordable working capital, and generate the business activity required for tax revenue growth. With 59% of government debt in floating-rate instruments, this reduction would immediately lower debt servicing costs consuming 46% of federal expenditure and delivering immediate fiscal relief of PKR 3 trillion annually.

Pakistani industry possesses significant manufacturing capacity, skilled workforce, and export potential constrained only by monetary policy. Regional competitors demonstrate that growth-supportive interest rates enable superior economic performance while maintaining stability. India's framework supports 6.5% projected growth, while China's accommodative policy underpins continued industrial development.

The upcoming MPC decision on 30th July determines whether Pakistani businesses receive the monetary support necessary for growth and competitiveness, or continue facing systematic disadvantages that ensure economic decline.

Pakistan's choice is clear: maintain destructive monetary restrictions while unemployment persists and revenues fall short, or adopt competitive policies that enable business success and economic prosperity.

Pakistani industry awaits policy leadership that recognizes the fundamental connection between business viability and national economic growth.