Oil prices set to snap two-day winning streak ahead of Fed decision

Business

Brent crude futures for November were down 45 cents at $73.25 a barrel as US slid 48 cents to $70.71

TOKYO (Reuters) – Oil prices fell on Wednesday and were set to snap a two-session winning streak ahead of a likely interest rate cut by the US Federal Reserve, as weak macroeconomic data weighed on demand despite the potential for more violence in the Middle East.

Brent crude futures for November were down 45 cents, or 0.6%, at $73.25 a barrel, as of 0458 GMT. US crude futures for October slid 48 cents, or 0.7%, to $70.71 a barrel.

"Weak macroeconomic data are deepening oil demand concerns. Money managers have turned net negative for the first time since 2011. End of the peak summer demand is also weighing on the market sentiment," analysts at ANZ said in a note.

However, prices found some support from the potential for more violence in the Middle East that may cause possible output disruptions in the key producing region after Israel allegedly attacked militant group Hezbollah with explosive-laden pagers in Lebanon.

"Investors are focusing on Fed's likely rate cuts, which could revitalise US fuel demand and weaken the dollar," said Mitsuru Muraishi, an analyst at Fujitomi Securities.

Traders kept bets that the Fed will start an anticipated series of interest rate reduction with a half-percentage-point move downward on Wednesday, an expectation that may itself put pressure on central bankers to deliver just that.

Hezbollah promised to retaliate against Israel after the pagers detonated across Lebanon on Tuesday, killing at least eight people and wounding nearly 3,000 others, including fighters and Iran's envoy to Beirut.

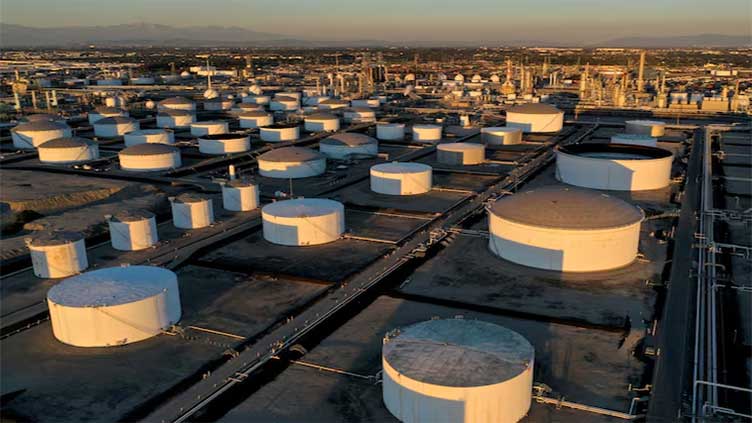

The market also found support from the expectation of US oil purchases for the Strategic Petroleum Reserve (SPR).

Analysts polled by Reuters estimated on average that crude inventories fell by about 500,000 barrels last week. The US Energy Information Administration's report is due on Wednesday at 10:30 am EDT (1430 GMT).