European stocks firm before Yellen testimony

London's benchmark FTSE 100 index climbed 0.71 percent to stand at 6,638.69 points in midday deals.

LONDON (AFP) - European stock markets rose solidly as traders looked ahead to the first testimony by the Federal Reserve s new head for clues over US stimulus plans.

Ahead of Janet Yellen s appearance before the House of Representatives committee on Tuesday, share prices were mostly higher despite some heavy falls for blue-chip companies, including British bank Barclays and French cosmetics giant L Oreal.

London s benchmark FTSE 100 index climbed 0.71 percent to stand at 6,638.69 points in midday deals.

Frankfurt s DAX 30 jumped 1.25 percent to 9,406.28 points and in Paris the CAC 40 advanced 0.56 percent to 4,260.80 compared with Monday s closing values.

"Traders are pricing in Yellen s dovish outlook, as she is likely to keep the stimulus package unchanged for the foreseeable future," said David Madden, market analyst at traders IG.

Investors are waiting to see if Yellen gives any indication that the central bank will slow down its stimulus tapering. In December, the Fed said it would cut its monthly purchases by $10 billion to $65 billion. It then announced a similar move this month, sending markets spinning.

Respected economist Yellen inherits the mantle of the world s most powerful central banker from Ben Bernanke, who guided the US and the global financial system through its deepest crisis since the 1930s during his eight years in the job.

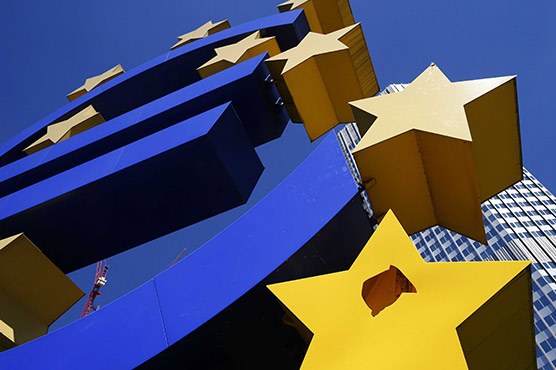

In foreign exchange trade on Tuesday, the European single currency climbed to $1.3666 from $1.3642 late in New York on Monday.

The euro dipped to 83.11 British pence from 83.17 pence, while the pound rose to $1.6449 from $1.6401.

The price of gold hit a three-month high at $1,287.80 an ounce on the London Bullion Market. It later stood at $1,282.76 an ounce, up from $1,277 on Monday.

In the British capital, all eyes were on Barclays, whose share price tumbled 5.53 percent to 259.77 pence after the banking giant revealed a loss at its investment arm.

Barclays said it will axe thousands of jobs but raise bonuses for its investment bankers this year, after posting a return to annual profits for the group overall.

Shares in Thomas Cook fell 1.35 percent to 182.90 pence. The British travel group said it had trimmed losses in its first quarter as deep cost-cutting offset a fall in sales caused by political turmoil in Egypt.

In Paris, L Oreal slid 3.33 percent 124.7 euros after announcing that Swiss food giant Nestle is to sell a chunk of its shares in the company, in a sign that it had dropped the option of a takeover.