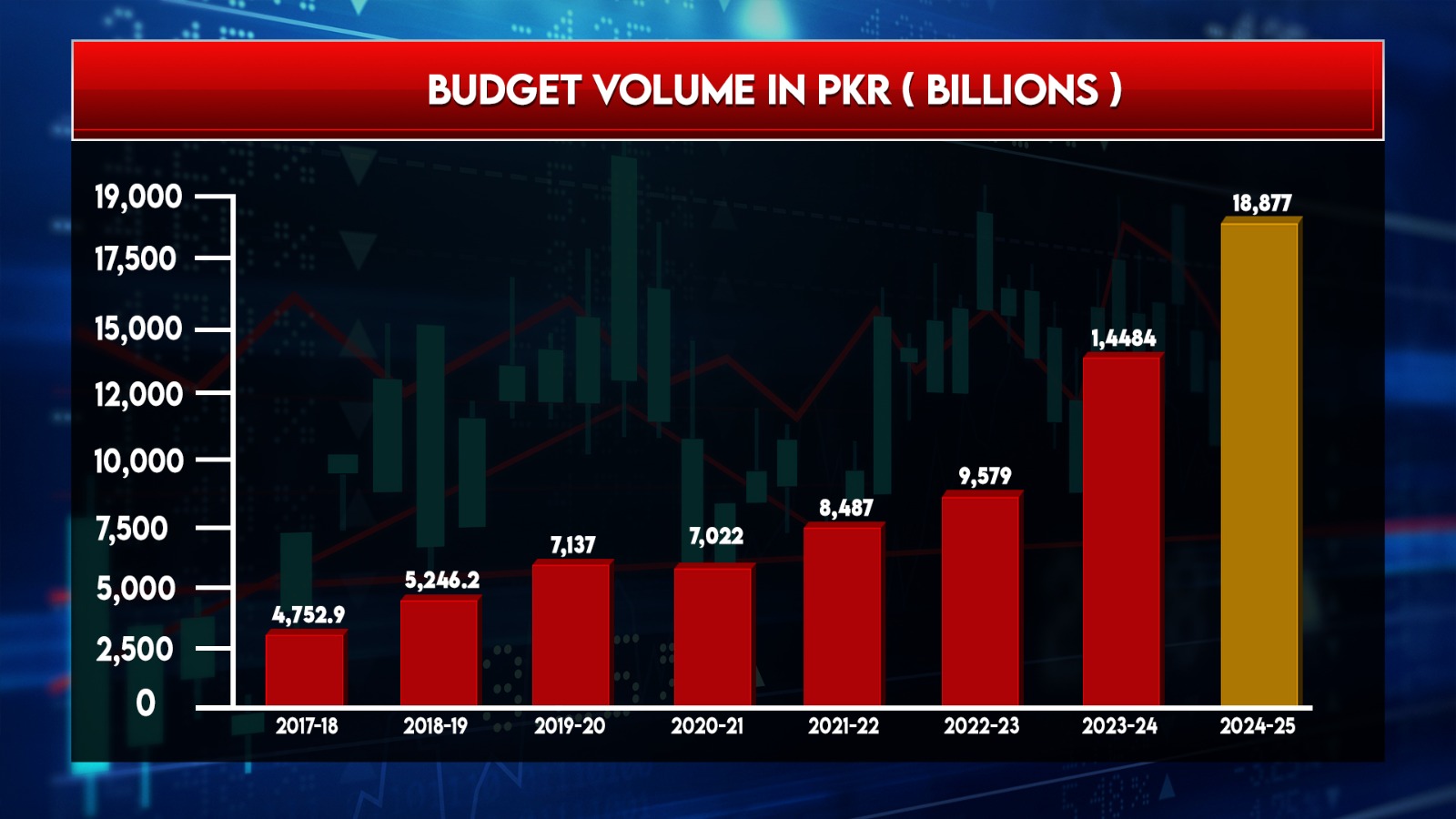

FinMin Aurangzeb unveils Rs18,877bn federal budget 2024-25 'on IMF watch'

Business

The opposition created ruckus in the National Assembly

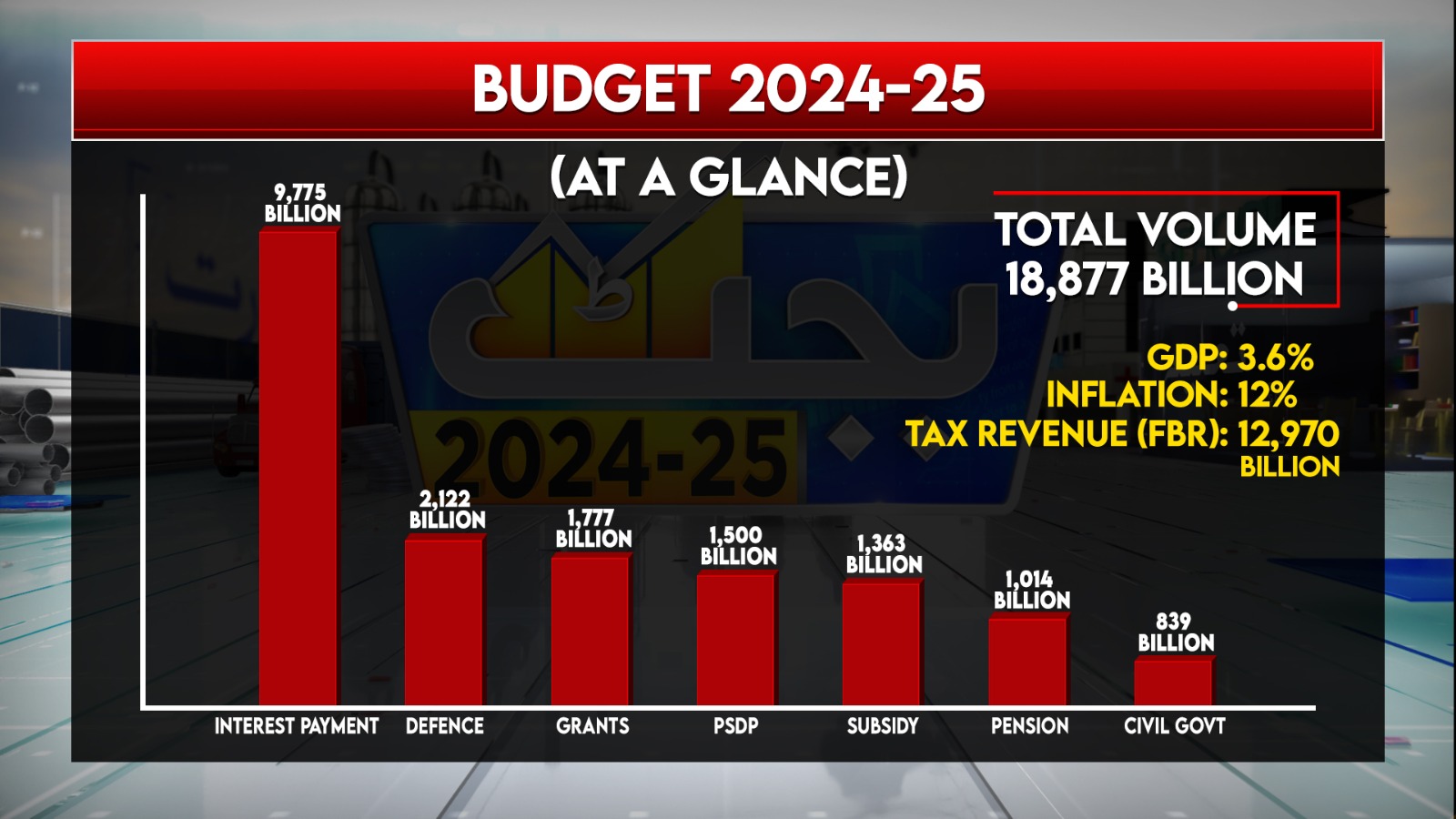

Rs2,122 billion for defence and Rs9,775 billion for interest payments on loans reserved

Target of GDP growth in the budget is 3.6pc, inflation to remain 12pc

Target of Rs12,970 billion tax collection set for FBR, increased by 38pc from last year

ISLAMABAD (Dunya News) - Finance Minister Muhammad Aurangzeb on Wednesday presented the federal budget for fiscal year 2024-25 with the total outlay of Rs18,877 billion.

Scenes of pandemonium were observed as soon as the session started as the opposition members brought the picture of PTI founder Imran Khan and disrupted the speech of the finance minister.

The opposition members surrounded the speaker’s dais and threw copies of the budget speech.

However, the finance minister - who was presenting his maiden budget - powered through his speech.

The total outlay of the budget stands at Rs18,877 billion with Rs9,775 billion reserved for the interest payments.

The budget is considered to be crafted in line with the IMF's requirements to secure another bailout, this time “larger and longer”.

As the minister started his speech, he thanked PM Shehbaz Sharif as well as other leaders of the government for their guidance in preparing the budget.

He said, “Dear speaker, I think that despite political and economic challenges, our progress on the economic front in the past one year has been impressive,”.

“Pakistan has another opportunity to improve itself and embark on the path of economic development. I request everyone not to waste this chance,” he said.

Target of GDP Growth is 3.6 percent, budget deficit 5.9pc of GDP, Inflation to remain 12 percent

The economic growth for the fiscal year (2024-25) is likely to remain at 3.6 percent. The budget deficit will remain at 5.9 percent of GDP (Rs7,283 billion). Inflation is likely to be 12 percent. Meanwhile, the primary surplus would remain at one percent of GDP.

Energy Sector

The energy sector will see Rs253 billion allocated, focusing on reducing losses and promoting wind and solar power, with efforts underway to freeze debt from power reforms and involve the private sector. The Pakistan Climate Change Authority will be activated to promote solar and wind energy.

Infrastructure and Water Resources

An amount of Rs827 billion has been reserved for infrastructure whereas Rs206 billion for water resources and Rs279 billion for transport and communication have been allocated.

Defence Allocation

In the federal budget, Rs2,122 billion have been reserved for defence. It reflects a 19.29 percent increase as the allocation for fiscal year 2023-24 was Rs1,804 billion.

The federal government had allocated Rs920 billion in the federal budget for 2017-18, Rs1,100 billion in 2018-19, Rs1,153 billion in 2019-20, Rs1,289 billion in 2020-21, Rs1,370 in 2021-22 and Rs1,563 billion in the budget for 2022-23.

FBR Tax Collection

Meanwhile, the FBR's tax collection for the next fiscal year would be around Rs12,970 billion which is 38 percent more than that of the outgoing year. The FBR will have to collect an additional revenue of Rs3,720 billion, Rs3,452 billion direct tax and Rs267 billion customs duty.

Development Projects

The finance minister said the government had increased spending on the development projects by 101 percent with the spending on the already running schemes to be increased by 81 percent. The government allocated Rs1,500 billion for development projects during the next financial year.

Federal Non-Tax Revenue

The target for federal non-tax revenue has been set at Rs3,587 billion while the net income of the centre would be around Rs9,119 billion.

Salaries, Pensions increased

The salaries of the governmental officials from grade 1 to 16 have been increased by 25 percent while for officers from grade 17 to grade 22, there would be an increase of 20 percent.

In the same way, pensions of the retired officers would be 15 percent more.

The minimum wage has been increased from Rs32,000 to Rs37,000.

Agriculture sector

For the agriculture sector which constitutes almost 24 percent of the GDP and 37 percent of the labour force, Rs50 billion have been allocated.

Science and IT Sector

A sum of Rs79 billion has been reserved for the expenditure on science and IT sector. An IT Park in Karachi would be established and efforts would be made to increase exports to 3.5 billion dollars this year. Pakistan, due to the huge youth population, has potential to earn a lot from this sector.

Human Development

As for the human development sector, the following steps would be taken:

In order to enhance the infrastructure and education facilities in 167 public schools in Islamabad, a specific amount would be allocated.

Also, a School Meal Program would also be introduced to enhance the intellectual and physical health of young students.

Interest Payment On Loans

An amount of Rs9,775 billion has been earmarked for interest payments on loans.

NFC Awards

The centre would give Rs1,777 billion to the provinces under the NFC awards. In case of emergency, Rs313 have been reserved.

Some items discussed in the budget include: the GST on the tier-1 textile retail sector will be enhanced from 15pc to 18pc. Sales of cigarettes without tax stamps will entail penalty, and the Federal Excise Duty (FED) on cement will be increased to Rs3 per kg from Rs2 per kg.

Customs duty exemptions on imports of hybrid cars will be abolished, and duties on steel and paper products will be increased. Incentives will be introduced for the import of plant and machinery, raw materials, and batteries for the solar panel industry.

The budget was presented a day after the government said economic growth of 2.4pc expected in the current year would miss a target of 3.5pc.

Pakistan is in talks with the IMF for a loan estimated to range from $6 billion to $8 billion to stabilise the economy. The session faced a brief delay as the PML-N tried to woo its crucial ally - PPP.

EXPORTS, INDUSTRIAL GROWTH MAIN FOCUS

Sources said mitigating people’s sufferings, transforming agriculture sector, promoting Information Technology (IT), boosting exports and industrial growth, and bolstering businesses would be the main focus of the document.

On the revenue side, the government would introduce measures for bringing improvements in the system of tax collection, broadening the tax base, and facilitation to tax-payers.

The budget has been prepared in close coordination among all departments and ministries involved in budget-related process including the presentation of the budget in parliament and launching of the Economic Survey, sources added.

PPP's reservations

Earlier, in a meeting of the parliamentary party of PPP which was held under the chairmanship of Bilawal Bhutto-Zardari, the members of the assembly expressed their concerns regarding the budget.

Sources said the participating members decided not to sit in the session citing concerns that the party was not briefed on the details. However, later they changed their mind when the meeting between Deputy PM Ishaq Dar and PPP chairman Bilawal took place.