PSX witnesses bullish trend as benchmark index gains 221.79 points

Of 93 traded companies in the KSE100 Index 61 closed up 30 closed down, while 2 remained unchanged.

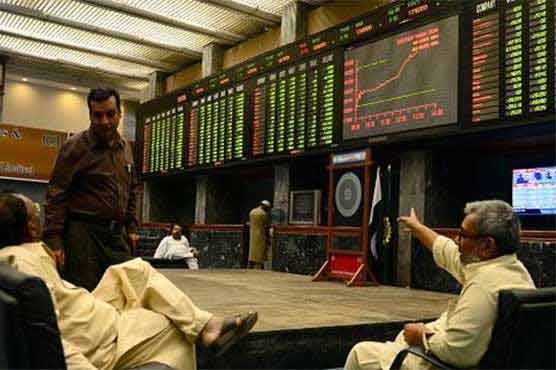

KARACHI (Dunya News) – Pakistan Stock Exchange on Tuesday witnessed bullish trend as the KSE-100 Index closed today at 40,664.60 points with a positive change of 221.79 points or 0.55 percent.

Of the 93 traded companies in the KSE100 Index 61 closed up 30 closed down, while 2 remained unchanged. Total volume traded for the index was 157.14 million shares.

Sectors propping up the index were Cement with 51 points, Pharmaceuticals with 27 points, Commercial Banks with 25 points, Oil & Gas Marketing Companies with 25 points and Oil & Gas Exploration Companies with 20 points.

On Monday, Pakistan Stock Exchange witnessed bearish trend as the KSE-100 Index closed today at 40,442.80 points with a negative change of 289 points.

On Sunday, Adviser to the Prime Minister on Finance Dr Abdul Hafeez Shaikh said the recent strong performance of Pakistan’s stock market was proof of “increasing investor confidence on stabilisation measures” employed by the Pakistan Tehreek-e-Insaf (PTI)-led government.

In a tweet, the premier’s aide stated that the 14.9 per cent gain of the KSE-100 Index in November was the highest one-month return over the past six years.

“The KSE-100 index is up by 14.9% in November 2019, highest one month return after May 2013. Since 16 August 2019, the index increased by 36.6% (10,500 points),” said Mr Shaikh.

His comments came after the Pakistan Stock Exchange had a phenomenal rally in the outgoing week despite political uncertainty that jolted investors briefly.

According to updates till Friday, the benchmark KSE-100 index managed to sustain its winning streak for the fifth successive week as it advanced 1,362 points or 3.59 per cent and crossed the 39,000 mark after eight months. It closed the week at 39,288 points.

“In November 2019, the KSE-100 index increased 5,084 points or 14.9pc month-on-month – this is the highest monthly return after May 2013,” said AHL Research in its report.