PSX plummets 785 points to close at 33084.73 points

A total of 130,285,140 shares were traded compared to the trade of 115,228,160 shares

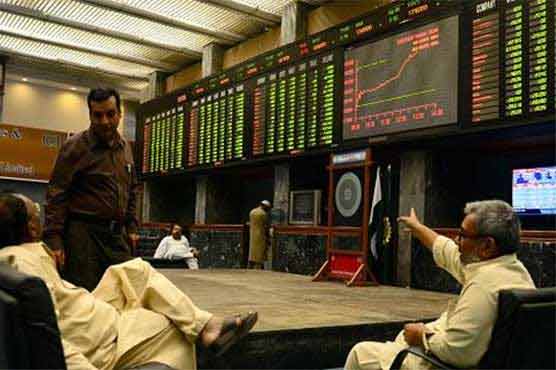

KARACHI (Dunya News) – The Pakistan Stock Exchange (PSX) Monday noted bearish trend as KSE 100 index went down by 785.42 points (2.32%) to close at 33084.73 points.

A total of 130,285,140 shares were traded compared to the trade of 115,228,160 shares during the previous day, whereas the value of shares traded during the day stood at Rs4.956 billion compared to Rs4.897 billion during last trading day.

Out of 351 companies, share prices of 25 companies recorded increase,313 companies registered decrease whereas 13 companies remained stable in today’s trading.

The three top traded companies were K-Electric Ltd with a volume of 11,200,000 shares and price per share of Rs3.89, Lotte Chemical with a volume of 9,885,000 and price per share of Rs16.13 and Bank of Punjabwith a volume of 7,999,000 and price per share of Rs09.79.

The top advancer was Nestle Pakistan with the increase of Rs235.76 per share, closing at Rs6000 while Atlas Honda Ltd was runner up with the increase of Rs15 per share, closing at Rs320.

The top decliners were Philip Morris Pakistan with the decrease of Rs65.14 per share, closing at Rs2832.36 and Bata (Pak) with the decrease of Rs51 per share closing at Rs1452.

In the previous week, the PSX remained lacklustre as investor participation was comparatively low amid lack of market moving triggers and investors in a state of uncertainty following the formal announcement of the Financial Action Task Force (FATF) to keep Pakistan in the grey list till Feb 2020. The benchmark KSE-100 index lost 605 points or 1.8 per cent, and settled at 33,870 points on Friday.

The volume declined 17pc to 115 million shares, from 137.9m while traded value on the contrary increased by 30pc to $31.3m.

According to stock market analysts, simmering Pak-India tensions and the current uncertain political situation in the country, and FATF’s warning to Pakistan to fully comply with its 27 recommendations to curb terror financing and money laundering – all contributed to the bearish trend in the market.

The Paris-based watchdog mentioned that Pakistan had largely addressed five of the 27 action items but expressed serious concerns with the overall lack of progress. It cautioned the country to swiftly complete its full action plan by February 2020 to stave off the blacklist.

On Oct 15, IMF Deputy Director in the Research Department Gian Maria Milesi-Ferrtti affirmed that Pakistan has remained steadfast on fiscal adjustment and has picked up economic stability as a result.

He said there were good signals on the confidence front that the exchange rate was more realistically showing the economic conditions. He added that investors were gaining confidence.

He outlined that Pakistan’s tax revenue has been increasing despite of several challenges to the state’s economy.

Earlier, economists were of the view that since the passage of the financial budget for the fiscal year 2019-20, the stringent policies would reflect themselves in what they termed “the downfall of the stock market.”