FY21-22: A look at performance of country's key sectors

Pakistan

Industrial sector grew by whopping 9.8% against government forecast of 6.5%

LAHORE (Dunya News) – With next budget around the corner, here is a look at targets and actual growth of key sectors during the outgoing fiscal year.

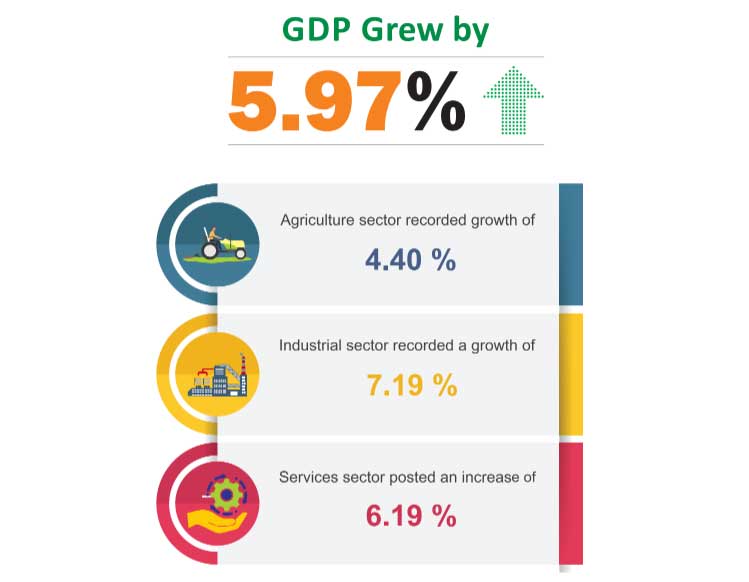

According to the documents available with Dunya News, the government aimed for a modest growth of 5 percent; however, in a positive development and against expectations the economy grew by 5.97 percent, nearly a percent over the official forecast.

All major sectors also grew more than official forecasts, with industrial sector grew by whopping 7.19% against the government forecast of 6.5%. The industrial sector was followed by services sector which grew by 6.19% compared to predictions of 4.7%.

Meanwhile, agriculture sector showed least progress of mere 4.40% in the outgoing fiscal year; however, it still grew more than government estimates of 3.5%.

Meanwhile, the government failed to tame inflation which crossed 11% (July – April) despite efforts by authorities to limit the price surge to 8.2%.

During fiscal year 2019-2020, services sector amounted to over half (57%) of country’s economy while agriculture clocked in at 22% followed by industrial sector at 21%.

Meanwhile, agriculture employs whopping 42% of the population despite being just over 20% of the country’s economy. Services sector employs 35% while livelihood of 23% countrymen is liked with industrial sector.

On tax front, despite government’s plans to increase share of direct taxes, indirect taxes amount to 60 percent of the total collection while direct taxation stands at just 40 percent.

International Financial Institutions like IMF, WB, ADB, etc., appreciated various policy measures taken by the Government to contain the pandemic and put the economy on the path of the recovery. However, the economy started overheating on account of significant growth in workers’ remittances translated into consumption, thus raising aggregate demand.

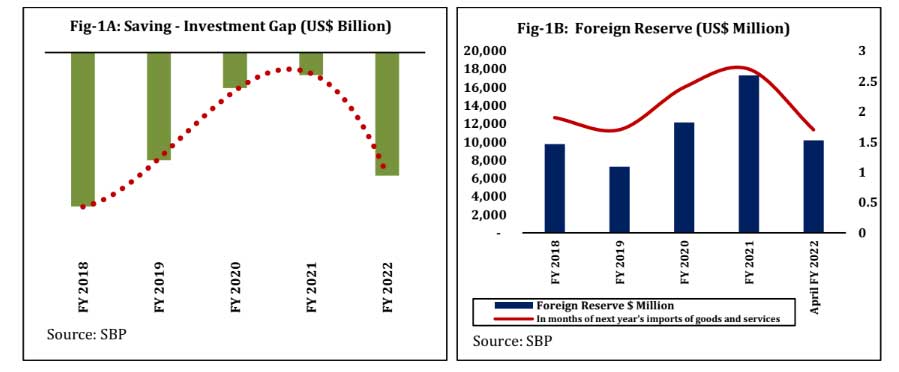

Further, improvement in Financial Account was not enough to offset the current account deficit, which exerted severe pressure on the exchange rate. For July - April FY2022, the current account deficit reached to US$ 13.8 billion against the deficit of US$ 0.5 billion last year implying widening in the Saving-Investment Gap started which in turn depleted foreign exchange reserves. Currently, Pakistan foreign reserves are equal to 1.7 months of imports of goods and services.

As far as exchange rate is concerned, during July-May FY2022, the exchange rate depreciated significantly and was recorded at 1US$ = Rs 197.87 on June 1, 2022 compared to 1US$ = Rs 157.55 on June 30, 2021, showing 20 percent depreciation.