Economic Survey 2019-20: Hafeez Sheikh says GDP down to negative 0.38% due to COVID-19

Hafeez Sheikh presented Economic Survey ahead of Budget 2020-21.

ISLAMABAD (Dunya News) – Adviser to the Prime Minister on Finance and Revenue, Dr Abdul Hafeez Shaikh said Thursday that country’s economy was stabilizing before the outbreak of coronavirus pandemic (COVID-19), which inflicted huge losses and derailed it towards negative growth of 0.38 percent.

.png)

Addressing at the launching ceremony of Pakistan Economic Survey for the outgoing fiscal year 2019-20, the advisor said that the fiscal year 2020, before coronavirus spread, showed dedicated efforts of the government for addressing structural issues that had caused macroeconomic imbalances back in FY 2018.

He said that the economic reforms programme and the implementation was also acknowledged by the international financial institutions while International Monetary Fund (IMF) had declared that Pakistan’s programme was on track and bearing fruits for the economy.

He said that the pre-COVID-19 economic recovery was also supported by macroeconomic indicators as on external side, the decline in current account deficit, buildup of foreign reserves and stable exchange rate.

On the fiscal side, there were significant improvements in all major indicators and the trend continued till March 2020, implying that the fiscal consolidation was on track.

The primary balance had witnessed a remarkable turnaround as it had posted a surplus of Rs193.5 billion during July-March FY2020 against a deficit of Rs463.3 billion last year.

He said that the government had repaid around Rs5,000 billion loans and was successful in reducing its expenditures, while no ministry or division was provided supplementary grant.

During this period, he added, the government even did not borrow a single penny during this period from State Bank of Pakistan. In addition the revenues had also witnessed significant growth of 17 percent whereas there was also significant growth in non-tax revenues.

Below are the important points of Economic Survey:

The fundamental weaknesses of Pakistani economy:

According to the survey, low tax to GDP ratio, poor savings rate and minimal export growth with negligible value addition etc. were further attenuated by misaligned economic policies like loose monetary policy and overvalued exchange rate which have made it difficult to control twin deficits; the fiscal and the current account.

These policies, in the short term, fueled demand and short-term growth, but has gradually eroded macroeconomic buffers, increased public debt and depleted international reserves.

The shift in economic policy undertaken by the present government has changed the course entailing readjustment in the fiscal and monetary policies.

The stabilization process gained momentum with the commencement of the IMF’s 39-months Extended Fund Facility (EFF) arrangement program in July 2019. The stabilization measures implemented to reduce the twin deficits had a profound impact on economic activity during the year. As the new fiscal year FY2020 began, the economy started to witness a remarkable turnaround which confirmed that the Government has taken appropriate policy actions to address the macroeconomic imbalances.

The stabilization efforts paid off in terms of sustained adjustment in current account deficit and continued fiscal prudence. For the first time in many years, the current account deficit posted a surplus in October, FY2019.

While primary balance continued to remain in surplus during the current fiscal year. During July-March, FY2020, fiscal deficit has been reduced to 4.0 percent of GDP, while current account deficit reduced by 71 percent during July-April, FY2020.

Growth and Investment

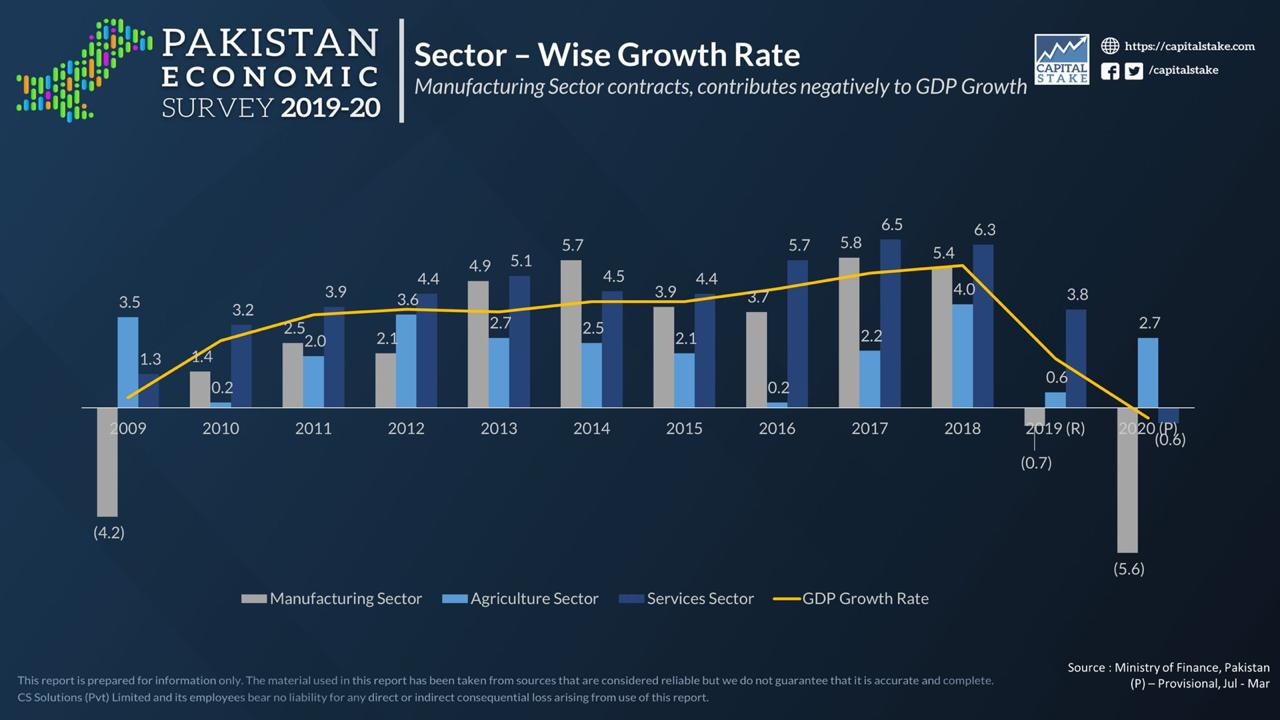

Although, provisional GDP growth rate for FY2020 is estimated at negative 0.38 percent, however, macroeconomic stabilization measures undertaken by the government over the past year resulted in significant reduction in Saving-Investment Gap which was mainly driven by reduction in trade deficit and increase in workers’ remittances. It is also mentionable that fiscal deficit remained contained in first three quarters of FY2020.

Historically, Private Consumption had significantly contributed in Pakistan’s economic growth. The pattern was likely to continue, however, due to COVID-19, private consumption suffered significantly.

In percentage of GDP, it dropped to 78.5 percent in FY2020 compared to 82.9 percent in FY2019. Private Investment as a percentage of GDP dropped to 9.98 percent from 10.29 percent in FY2019 while Public Investment (including General Government investment) has shown improvement as it remained 3.8 percent compared to 3.7 percent last year.

However, there was 13.2 percent growth in Public Investment (including General Government investment) during FY2020, while it declined by 21.6 percent last year.

The economy of Pakistan like other economies has a diverse structure with three main sectors -agriculture, industry and services. The agriculture sector, as mentioned earlier, grew by 2.67 percent. The crops sector has witnessed positive growth of 2.98 percent during FY2020 mainly due to positive growth of 2.90 percent in important crops.

According to Pakistan Bureau of Statistics, fourth quarter has been estimated by keeping in view the lockdown situation faced by the industrial sector due to COVID-19.

Significant impact has been observed in the manufacturing sector, particularly Large-Scale manufacturing and Small-Scale Manufacturing. The provisional growth in industrial sector has been estimated at -2.64 percent mainly due to a negative growth of 8.82 percent in mining and quarrying sector and decline of 7.78 percent in large-scale manufacturing sector.

Due to lock down situation in the country, the growth estimates of Small-Scale Industry for FY2020 are 1.52 percent.

Similar to the industrial sector, services sector of the economy has also witnessed significant impact of the lock down situation in the country due to COVID-19, particularly in Wholesale and Retail Trade and Transport Sectors. The services sector has declined provisionally at 0.59 percent mainly due to 3.42 percent decline in Wholesale and Retail Trade sector and 7.13 percent decline in Transport, Storage and Communication sectors.

Finance and insurance sector witnessed a slight increase of 0.79 percent. The Housing Services, General Government Services and Other private services have contributed positively at 4.02, 3.92 and 5.39 percent respectively.

Agriculture

The agriculture sector recorded strong growth of 2.67 percent, considerably higher than 0.58 percent growth achieved in last year.

Regarding “Kharif” crops, Rice production increased by 2.9 percent to 7.410 million tonnes and Maize production by 6.0 percent to 7.236 million tonnes while Cotton production declined by 6.9 percent to 9.178 million bales and sugarcane production by 0.4 percent to 66.880 million tonnes.

Wheat is the most important crop of “Rabi”, which showed growth of 2.5 percent to reach 24.946 million tonnes. Other crops showed growth of 4.57 percent mainly due to increase in production of pulses, oilseeds and vegetables.

Cotton ginning declined by 4.61 percent due to decrease in production of cotton crop. Thus, the crops sector experienced a remarkable growth of 2.98 percent due to increase in growth of important crops by 2.90 percent.

Livestock Sector achieved the growth of 2.58 percent. The Fishing sector grew by 0.60 percent, while Forestry sector increased by 2.29 percent.

During 2019-20, the total availability of water for the Kharif crops 2019 reached 65.2 million MAF showing an increase of 9.4 percent over 59.6 MAF of Kharif 2018.

During Rabi season 2019-20, the total water availability reached 29.2 MAF, showing an increase of 17.7 percent over Rabi 2018-19 and 19.8 percent less than the normal availability of 36.4 MAF.

Fertilizers production during FY2020 (July-March) increased by 5.8 percent over the same period last year on the back of additional supply of gas for fertilizers. The fertilizer import decreased by 20.7 percent.

During FY2020 (July-March), there was an uptick in agriculture credit disbursement, the banks have disbursed Rs 912.2 billion higher by 13.3 percent than the disbursement of Rs 804.9 billion made during the same period last year.

Manufacturing

Manufacturing and Mining The Large-Scale Manufacturing (LSM) declined by 5.4 percent during July-March FY2020 as compared to 2.34 percent decline during the same period last year.

There are number of factors which contributed to negative growth of LSM. Pak rupee depreciated by 3.9 percent during July-March FY2020 which increased the cost structure of industries in general and for those relying on imported raw materials in particular.

Furthermore, policy rate was kept high to contain inflation which discouraged investment. Subdued demand further hampered the overall production and performance of the industry. Certain sector-specific issues also contributed to the decline in LSM.

Automobile sector alone accounted for major portion of contraction in LSM. Its prices witnessed multiple upward revisions due to PKR depreciation which held the potential buyers from making booking and purchases.

The Mining and Quarrying sector showed negative growth of 8.82 percent during FY2020 as against 3.19 percent decline last year.

This sector is lagging behind despite huge potential due to interconnected and cross cutting issues like poor regulatory framework, insufficient infrastructure at mines sites, outdated technology installed, semi-skilled labor, low financial support and lack of marketing.

Minerals that witnessed negative growth are Coal 6.34 percent, Natural gas 6.36 percent, Crude Oil 10.55 percent, Chromite 54.5 percent, Magnesite 55.9 percent, Lime Stone 14.71 percent, Marble 3.62 percent and Iron Ore 32.73 percent.

However, Barytes, Quartz, Ocher and Dolomite posted a positive growth of 241.6 percent, 130.8 percent, 68.8 percent and 16.27 percent, respectively.

Fiscal Development

The fiscal outcomes remained strong during the first nine months of current fiscal year after sharp deterioration in FY2019. The fiscal deficit has reduced to 4.0 percent of GDP during July-March, FY2020 against 5.1 percent of GDP in the comparable period last year.

Similarly, a remarkable turnaround is visible in primary balance, which posted a surplus of Rs 194 billion during July-March, FY2020 against the deficit of Rs 463 billion.

Overall, the improvement in fiscal account is largely attributed to higher provincial surplus and sharp rise in non-tax revenues.

FBR tax collection grew by 10.8 percent to Rs 3,300.6 billion during July-April, FY2020 against Rs 2,980.0 billion in the comparable period last year.

Various policy measures such as charging sales tax on more items at retail price under 3rd Schedule, reinstatement of taxes on telecom services, an upward revision of tax rates on various salary slabs, an upward revision in the federal excise duty (FED) rates and end of preferential treatment for certain sectors provided impetus to tax collection were taken during FY 2020.

Non-tax revenues grew sharply during July-March, FY2020 on the back of SBP profit and rise in receipt of telecom licenses renewal fees. It stood at Rs 1,095.6 billion during July-March, FY2020 against Rs 421.6 billion in the same period of FY2019. Thus, total revenues grew by 30.9 percent during July-March, FY2020 against 0.04 percent growth in the comparable period of FY2019.

Total expenditures grew by 15.8 percent during July-March, FY2020 over the same period last year. Within total, current expenditure posted 16.9 percent growth in nine months of current fiscal on account of higher mark-up payments, grants for social spending and expenditures on social protection.

Similarly, PSDP spending witnessed a significant rise both at federal and provincial levels. Overall PSDP expenditures grew by 24.9 percent during July-March, FY2020 over previous year.

Fiscal position till March, 2020 indicated improved fiscal performance, however, the COVID-19 pandemic has brought significant challenges for the economy; in particular, fiscal accounts are expected to come under significant pressure.

At present, the government is increasing the expenditures on public health and strengthening social safety net programs, along with introducing various other measures to lessen the impact of the COVID-19 on economy.

Similarly, achieving revenue targets of both tax and non-tax segments would be challenging due to disruption in economic activity. The short term economic impact of COVID-19 is expected to be significant creating large fiscal and external financing needs.

Capital Markets & Corporate Sector

Capital markets help to channelize savings to the most productive investments. In FY2020, Pakistan’s capital markets faced challenges on multiple fronts.

High inflation, austerity measures, oil price crash and COVID-19 pandemic jolted the capital market. As a result, Pakistan’s benchmark KSE-100 index recorded a modest growth of 0.61 percent in the first ten months of FY2020.

The index kicked-off with 33,901.58 points on July 1st, and reached the year’s peak of 43218.67 points on January 13th, 2020. After the COVID-19 outbreak, capital began flowing out of the Pakistan stock market and the index plunged to 27228.8 points and market capitalization closed at Rs 5380.17 billion on March 25th.

However, the government’s stimulus package provided relief to investors as KSE-100 index gained 6877.84 points (↑25.25 percent) since March 25th and index closed at 34111.64 points on April 30th.

Similarly, Market Capitalization increased by Rs 991.54 billion (↑18.4 percent) since March 25th and closed at Rs 6376.71 billion on April 30th.

SECP took a number of measures to facilitate the market and to absorb the prevailing shocks. The duration of index-based market halts has been increased from 45 minutes to 60 minutes; securities brokers have been allowed to activate and operate the Disaster Recovery terminals for trading purposes during normal operations of PSX.

SECP has also notified Corporate Rehabilitation Regulations, 2019 and Corporate Restructuring Companies Rules, 2019.

Inflation

During first seven months of CFY, inflationary pressures were observed and headline inflation rose to 14.6 percent in January 2020.

The inflation rate started easing out due to government policies after January and for the period July-April FY2020 recorded at 11.2 percent against 6.5 percent during the same period last year.

The other inflationary indicators like Sensitive Price Indicator (SPI) recorded at 14.3 percent against 4.2 percent over the same period last year. Wholesale Price Index (WPI) recorded at 12.2 percent during Jul-April FY2020 compared to 16.2 percent same period last year.

Economic Stimulus Package, Ehsas Emergency Relief Programme, Subsidies to USC and reduction in petroleum prices, etc., will provide multidimensional positive impacts to all segments of society especially poor families. All these measures helped in contracting the CPI to single digit which fell to 8.5 percent in April 2020.

Trade and Payments

Exports during July-April, 2019-20 remained $ 19.7 billion compared to $ 20.1 billion during July-March, 2018-19, posting a decline of 2.4 percent. A sharp decline in REER due to market based exchange rate and the government’s initiative to provide cheaper electricity to the textile sector have enhanced the competitiveness of the Pakistani products in the global market.

The total imports during July-April FY2020 declined to $ 36.1 billion as compared to $ 40.3 billion same period last year, thus registered a decline of 16.9 percent.

During Jul-April FY2020, remittances increased to $ 18.8 billion as compared to $ 17.8 billion during same period last year, with a growth of 5.5 percent.

During July-March FY2020, current account deficit (CAD) reduced by 73.1 percent to US$ 2.8 billion (1.1 percent of GDP) against US$ 10.3 billion last year (3.7 percent of GDP).

Pakistan’s total liquid foreign exchange reserves increased to US$ 17.1 billion by end March 2020, up by US$ 2.6 billion over end-June 2019. The improvement in the Foreign Exchange reserves led to 3.6 percent appreciation of Pak rupee against US dollar during Jul-February FY2020.

The COVID-19 pandemic has generated both demand and supply shocks across the global economy and has posed significant challenges for exports to increase further in coming months.

Pakistan, as net oil importer, would benefit from the decline in global oil prices in terms of reduced import bill and contraction in CAD. Despite adverse impact of pandemic on economy the overall external account liquidity has actually improved due to decline in oil and other international commodity prices.

Public Debt

Total public debt was recorded at Rs 35,207 billion at end March 2020 compared with Rs 32,708 billion at end June 2019, registering an increase of Rs 2,499 billion during first nine month of current fiscal year while Federal Government borrowing for financing of its deficit was Rs 2,080 billion.

This differential is mainly attributable to depreciation of Pak Rupee, increase in cash balances of the Federal Government and difference between face value (which is used for recording of debt) and the realized value (which is recorded as budgetary receipt) of PIBs issued during the period.

Public debt portfolio witnessed various positive developments during the ongoing fiscal year. Most of the net domestic debt raised was through medium-to-long-term government securities (Pakistan Investment Bonds) and National Saving Schemes.

The cost of borrowing through long term government bonds declined. No new borrowing was made from SBP during ongoing fiscal year. To diversify investor base in government securities and capitalize liquidity available with Islamic Financial Institutions, government has started issuance of 5-Year Floating Rate Sukuk.

Domestic debt was recorded at Rs 22,478 billion at end March 2020. Domestic borrowing operations remained quite successful during ongoing fiscal year despite challenging macroeconomic situation.

External public debt stock reached US$ 76.5 billion (Rs 12,729 billion), witnessing an increase of US$ 3.0 billion during first nine months of current fiscal year.

Interest expense is expected to remain significantly less than the budgeted amount in 2019-20 owing to re-profiling of short-term debt into long-term debt and sharp decline in cost of borrowing in longer tenor.

Over the medium term, government objective is to reduce its “Gross Financing Needs (GFN)” through various measures mainly including

(i) Better cash flow management through a treasury single account

(ii) Lengthening of maturities in the domestic market keeping in view cost and risks trade-off

(iii) Developing regular Islamic based lending program and

(iv) Availing maximum available concessional external financing from bilateral and multilateral development partners to benefit from concessional terms and conditions.

Government also aims to bring and maintain its Debt-to-GDP and Debt Service-to-Revenue ratios to sustainable levels through combination of greater revenue mobilization, rationalization of current expenditure and efficient/productive utilization of debt.