Berkshire decreases shares in banks, TSMC but increases in Apple

Business

Apple which Buffett considers more as consumer products firm is one of Berkshire's few acquisitions

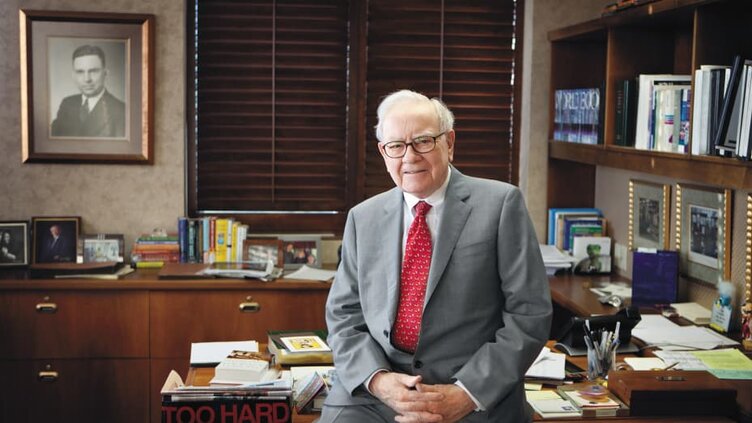

NEW YORK/BENGALORE (Reuters) - In the fourth quarter Warren Buffett's Berkshire Hathaway Inc decreased its shares in several banks and Taiwanese contract chipmaker TSMC while increasing its stakes in Apple Inc.

According to a regulatory filing Berkshire reduced its holdings in Taiwan Semiconductor Manufacturing Co Ltd by 86.2% to 8.29 million sponsored American depositary shares. This occurs around three months after Berkshire said that it had purchased TSMC stock for more than $4.1 billion which caused the stock price of the largest contract chip manufacturer in the world to rise.

In Tuesday's after-hours trading in the United States, TSMC depository receipts decreased 4%. As trading on Wednesday began in Asian markets TSMC shares opened 3.3% down in Taiwan. Depositary shares in TSMC have increased by over 32% this year closing on Tuesday at $97.96. The company did not immediately reply to a request for comment.

"On TSMC, Berkshire generated a little profit. Not a massive, massive victory for Berkshire, "said CFRA Research analyst Cathy Seifert. Her estimates show that Berkshire paid about $68.5 for it and received $74.5 for it.

Along with TSMC, Buffett also sold 91.4% of its US Bancorp stock amounting to 6.7 million shares and about 60% of its shares in BNY Mellon amounting to 25.1 million shares. At current pricing these cutbacks came to around $5.5 billion.

Additionally shares of Citigroup Inc., Bank of America and Jefferies are owned by Buffett's conglomerate. In its portfolio of American publicly traded firms Berkshire reduced its holdings in Chevron, Activision Blizzard, the company behind the video game "Call of Duty" and Kroger. Activision Blizzard's purchase by Microsoft Corp is now in the process of being finalized. Microsoft will defend the agreement in a closed-door session on February 21 in front of European Union and national antitrust regulators.

Apple which Buffett considers more as a consumer products firm is one of Berkshire's few acquisitions. According to the report Berkshire increased its ownership of Apple by 5.8% by purchasing an additional 20.8 million shares for $3.2 billion. Apple's stock has increased by over 18% so far this year. Additionally Louisiana-Pacific Corp., a supplier of building materials, received a fresh $84 million investment from Berkshire.