New York's Attorney General sues Mashinsky on defrauding investors

Business

Mashinsky asked to pay penalties, be barred from doing business in New York

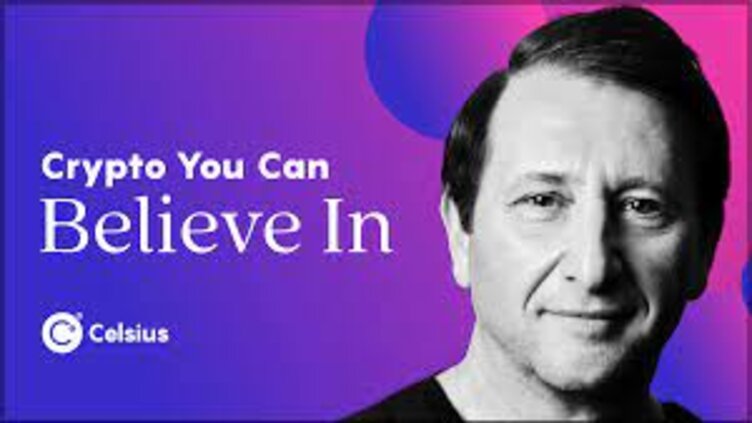

NEW YORK (Reuters) - The creator of Celsius Network, Alex Mashinsky, is being sued by the attorney general of New York for allegedly defrauding investors out of billions of dollars in digital currency by hiding the deteriorating state of his now-insolvent crypto currency lending platform.

Letitia James, the attorney general, filed a complaint alleging that Mashinsky continued to promote Celsius as a secure alternative to banks while hiding hundreds of millions of dollars in losses on hazardous investments and offering interest rates as high as 17 percent on deposits.

Mashinsky is accused of violating many laws including the Martin Act of New York and is asked to pay penalties as well as be barred from conducting business in New York.

The complaint was filed in a state court in Manhattan although Celsius is not named as a defendant.

Crypto lenders became well-known during the COVID-19 outbreak by offering depositors quick access to loans and large interest rates. Then, in an effort to benefit from the discrepancy, they loaned tokens to institutional investors.

But in 2022 after a selloff in cryptocurrency markets and the demise of the terraUSD and luna tokens the business model frequently proven to be unsustainable.

According to a court document Celsius had $9 billion in liabilities at the end of November including more than $4.3 billion in consumer debt.

In order to determine if Celsius was mishandled US Bankruptcy Judge Martin Glenn has appointed an examiner in September.

Mashinsky left his position as CEO of Celsius in September citing that he was dedicated to assisting with the restoration of investor monies.