Economy 2021: The highs and the lows for Pakistan

Business

A look at the performance of Pakistan's economy in last three years.

The year 2021 proved to be disruptive for the economy of Pakistan like previous years. The ruling Pakistan Tehreek-e-Insaf (PTI) failed to control the deteriorating situation in the country even in the third year of its rule.

If we look at the economic statistics, we can see that everything - from inflation to total national debt, total import bill of the country, monetary policy issued by SBP and unemployment figures - have moved up.

INTEREST RATE

For the first nine months of 2021, the SBP kept the interest rate unchanged at 7%, which was raised on 20th September with 25 basis points to 7.25%.

On November 19, 2021, the SBP raised interest rate by another 150 basis points to 8.75٪.

Then on December 14, 2021, the SBP announced its monetary policy again, raising it by 100 basis points to 9.75%. Businesses that have borrowed from banks have to pay higher interest rates along with inflation. For these reasons, chances of expanding businesses get shrink, and in such a scenario, employment opportunities for people already crushed by inflation reduce further.

It is true that when inflation rises, monetary policy is tightened, which stabilizes prices, but such measures also increase unemployment.

RUPEE DEPRECIATION

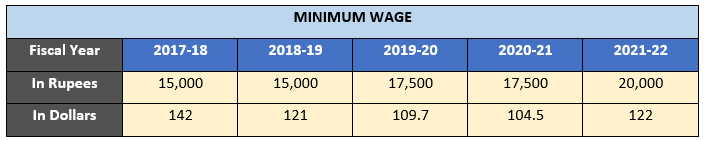

During the incumbent PTI-led government’s tenure, the rupee witnessed massive depreciation from Rs123.9 against the US dollar in August 2018 to Rs178 against the US dollar in December 2021, over the last 40 months.

PETROL PRICE

In August 2018, price of per liter petrol was around 95 rupees per liter, in January 2019 Rs 91 per liter, in January 2020 Rs 117 per liter, in January 2021 Rs 106 per liter and in the last month of the year, the price remained at 141 per liter.

UNEMPLOYMENT

According to economists, the country’s unemployment rate is expected to reach 5.1 percent in 2021. According to the data released by the Pakistan Bureau of Statistics, the total number of Pakistan’s labor force in 2018 was about 65.5 million, while at that time the unemployment rate was 5.8 percent.

According to the Bureau of Statistics, the number of people employed in the country before the Corona outbreak was about 55.7 million, so in 2019, about 10 million people were unemployed in Pakistan. However, the lockdown caused by the Corona epidemic led to a further 22% increase in unemployment, which reduced the number of employed people to 35 million.

Not only that, during the lockdown, 37% or about 26 million people lost their jobs while 12% or about 7 million people faced pay cuts. The lockdown triggered by coronavirus hit most of the daily wagers. At the same time, 74% of those facing unemployment belonged to the formal sector.

The easing of the lockdown has created employment opportunities and, according to the PBS, the country employs about 52.5 million people at the moment.

According to official figures, 24.3% of Pakistan’s population lived below the poverty line in 2015. However, the IMF has pointed out that due to the corona epidemic and economic slowdown, 40% of the population is feared to be living below the poverty line.

If the IMF’s observation proves to be true, the number of people living below the poverty line in the country could exceed 80 million. According to renowned economist Dr. Hafeez Pasha, the number of unemployed people in the country at this time has reached 8.5 million, which was 3.79 million before the PTI government, while according to the Ministry of Overseas Pakistanis 1.2 million people went abroad in search of employment in the last three years.

According to the IMF, the unemployment rate in Pakistan was 4.1% in 2019 and reached 4.5% in 2020, and now the country’s unemployment rate is expected to reach 5.1% in 2021.

BUDGET DEFICIT

Before coming to power, the Pakistan Tehreek-e-Insaf (PTI) had vowed to reduce the country’s fiscal deficit as much as possible, but the statistics tell a different story. In June last year, when announcing the budget for the fiscal year 2022, the government set a budget deficit of Rs 3,420 billion, which is Rs 225 billion more than the fiscal year 2021. Thus, the government has increased its budget deficit by 7% in one year. In the fiscal year 2021, the total budget deficit was Rs 3,195 billion.

It is also true that before the PTI came to power, the federal budget deficit was at its historic level. In the last term of the previous government in the fiscal year 2018, Pakistan’s budget deficit was Rs. 1,891 billion.

Similarly, the total volume of the country’s GDP was Rs 34,396 billion, thus the fiscal deficit before the current government came to power was 5.5% of GDP.

After Imran Khan came to power, steps were taken to improve the tax collection system, reduce government expenditure and expand the tax network but despite all this, the country’s budget continued to move towards deficit.

If we look at the statistics released by the Finance Ministry, in the fiscal year 2019, the government expected to keep the budget deficit at Rs 1,890 billion while the country’s GDP was set at Rs 38,388 billion.

However, after the review, the budget deficit reached the level of Rs 2,776 billion which became 7.2% of the country’s GDP in that financial year.

Something similar happened during the last financial year when the budget deficit was set at Rs 3,137 billion by the government, which was 7.1 percent of the country’s GDP, while the volume of the country’s GDP was set at Rs 44,000 billion.

However, once again these figures were revised and the budget deficit crossed Rs 3,800 billion, while the country’s GDP reached Rs 41,727 billion. Thus, the national budget deficit during fiscal year 2020 was 9.1% of the country’s GDP.

In the fiscal year 2021, the country’s budget deficit further increased to Rs. 3,195 billion which is 7% of the total GDP of the country, while the government has fixed the total volume of GDP at Rs. 45,567 billion in the current fiscal year.

If the PTI’s three-year tenure is compared, the country’s budget deficit has increased by 81% from Rs 1,891 billion to Rs 3,420 billion which means the overall budget deficit has increased by Rs. 1,529 billion after the government came to power.

FBR TAX TARGETS AND COLLECTIONS

The government has set a tax collection target of Rs 5,829 billion for the fiscal year 2022. The Federal Board of Revenue has achieved a net revenue of Rs 2,314 billion in the current fiscal year between July and November, which is Rs 298 billion more than the target of Rs 2,016 billion set for the period.

Similarly, in pursuit of the revenue target of Rs. 408 billion in November, the FBR achieved revenue of Rs. 470 billion in November and collected Rs. 62 billion in addition to the target set earlier. This is an increase of 35.2% over the net revenue of Rs 348 billion achieved in November last year.

Similarly, the gross revenue was Rs 2,437 billion this year as compared to Rs 1,783 billion in July-November 2020 last year --an increase of 36.7%.

Refunds of Rs 123 billion were issued from July to November 2021, up from Rs 88 billion in the same period last year. Refunds have increased by 40.5%.

According to the data, the FBR achieved a net revenue of Rs 4,732 billion in the fiscal year 2021, which is Rs 41 billion more than the target of Rs 4,691 billion set for the period.

Also, in the fiscal year 2020, the net revenue achieved from July to June increased by 18% as compared to Rs. 3,997 billion.

The improvement in revenue collection indicates that the country’s economic activity heading towards recovery, even though the country is currently facing the fourth wave of the corona epidemic.

In the fiscal year 2021, the number of people filing income tax returns for the tax year 2020 reached 3 million 10 thousand which was 26 million 70 thousand in the same period last year. Similarly, the number of people filing tax returns has increased by 12%.

Taxes paid with tax returns stood at Rs 52 billion as against Rs 34 billion in the same period last year. Therefore, in the fiscal year 2021, the tax payment witnessed an increase of 52%. During the last fiscal year 2021, the FBR collected a total of more than 4,732 billion in taxes.

(Data compiled by Mehroz Ali Khan, edited by Tayyab Khan)