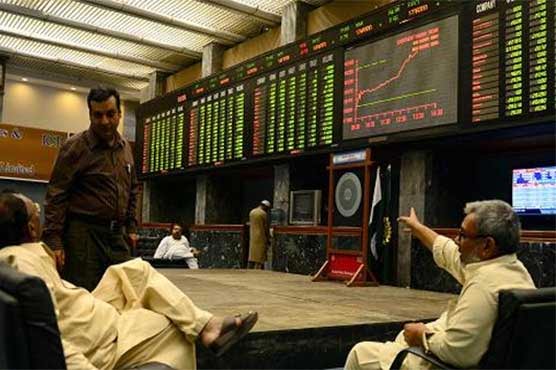

Stock market fluctuates after crossing 40,000-level

Yesterday, the index propelled by massive 836 points and rose to 40,124 points.

KARACHI (Dunya News) – Pakistan’s stock market on Tuesday has been fluctuating after it stormed past the 40,000-level yesterday. The benchmark KSE 100-share Index today touched 40,444.05 points and then returned to 39,787.74 points.

Yesterday, the index propelled by massive 836 points and rose to 40,124 points.

According to data compiled by Bloomberg, Pakistan’s benchmark KSE-100 rose 2.1% to close at the highest level in more than nine months. The key index has surged 40% since a low in August that makes it the top global performer globally.

“This is big for the nation that has been dealing with an economic slowdown,” said Faisal Bilwani, head of international sales at Alfalah CLSA Securities. “Investor confidence is changing to positive.”

Yesterday, Moody’s Investors Service raised Pakistan’s credit rating outlook to stable from negative, citing the International Monetary Fund program that helped stabilize the economy.

The outlook was changed because of narrowing current account deficit, currency flexibility and lower external vulnerability risks, Moody’s said in a statement on Monday. The ratings company kept the credit assessment for the nation at B3, a junk rating.

Moody’s expects the nation’s current account deficit to continue narrowing to average about 2.2% of gross domestic product in the current and next fiscal year compared with 5% in fiscal 2019, according to the statement.

“The worst is behind us,” said Khurram Schehzad, Chief Executive Officer at Karachi-based advisory Alpha Beta Core Solutions Pvt. “Stability has largely subsided macro economic fears.”

After Chinese investors expressed keen interest in pouring at least $2 billion into Pakistan’s stock market, PSX Chairman Sulaiman S Mehdi at a press briefing on Friday stated: “Small Chinese stockbrokers having $52 billion in assets under management have shown interest in investing at least $2 billion in shares at the Pakistan Stock Exchange (PSX).”

According to updates till Friday, the benchmark KSE-100 index managed to sustain its winning streak for the fifth successive week as it advanced 1,362 points or 3.59 per cent and crossed the 39,000 mark after eight months. It closed the week at 39,288 points.

“In November 2019, the KSE-100 index increased 5,084 points or 14.9pc month-on-month – this is the highest monthly return after May 2013,” said AHL Research in its report.

Earlier, State Bank of Pakistan Governor Reza Baqir had hinted at maintaining the status quo in the monetary policy, which provided much-needed clarity and helped the bourse trade in the green zone.

In the monetary policy announcement, the State Bank of Pakistan (SBP) has kept the interest rate unchanged at 13.25pc.

Foreign investment in government backed treasury bills was recorded at almost USD 800 million since the beginning of FY20, attributable to waning concerns on the economic front has effectively supported the slight growth in FX reserves of the SBP and consequentially, kept the exchange rate parity stable.

The state bank had said market sentiment has begun to gradually improve on the back of sustained improvements in the current account and continued fiscal prudence.

It had said that the current account balance recorded a surplus in October 2019 after a gap of four years, a clear indication of receding pressures on the country’s external accounts together with the end of deficit monetisation has qualitatively improved the inflation outlook.

It had outlined that recent economic data suggest that economic activity is strengthening in export oriented and import competing sectors while inward oriented sectors continue to experience a slowdown in activity.

Specifically, large-scale manufacturing (LSM) shows gains in electronics, engineering goods and fertilizer sectors and decline in auto, food, and construction allied industries of steel and cement.

The external sector continued to show steady improvement, reflecting the benefits of recent policy adjustments and other factors. In the first four months of the current fiscal year, the current account deficit contracted by 73.5 percent to 1.5 billion dollars.

This improvement reflected a notable reduction in imports, a modest growth in exports and steady workers’ remittances.