Banking sector's credit growth to slow: Fitch Solutions

The report also determined an increase in NPL as corporate profitability shrinks.

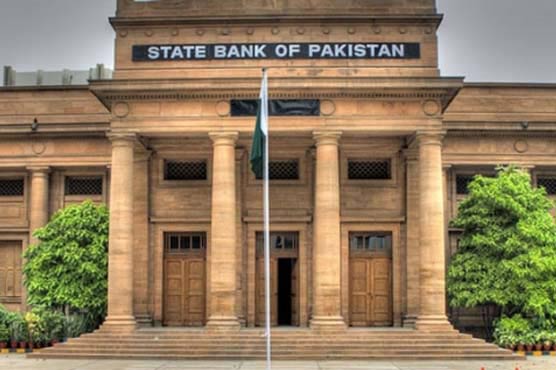

LAHORE (Dunya News) – A report released by the Fitch Solutions on Thursday determined that the rapid pace of credit growth in the banking sector has been set to reduce in the coming months, and expected refinancing risks to rise as the effect of the tightening by the central bank in 2018 begins to trickle in.

“Together with higher oil prices, this could create a downward cycle of lower loan growth, weaker asset quality, and reduced profitability and capitalization,” said the report.

The research agency believes the country’s external woes aren’t over yet and financial assistance in one form or the other should help avert a destabilizing currency collapse and an outright recession in the near-term, which would potentially lead to a surge in NPLs as corporate profitability tanks , particularly in the import dependent sectors .

It said this would potentially contribute to an increase in NPL as corporate profitability shrinks, especially in the import-dependent sectors.

The research agency said the current Pakistan Tehreek-e-Insaf (PTI) government has been striving for ‘unconventional’ sources of funding to avoid the balance of payment crisis.

“Furthermore, the worst-case scenario of the balance of payment crisis appears likely to be avoided in the near-term with foreign bilateral assistance.

Islamabad has secured $3 billion in foreign loans from the UAE and is aimed to acquire further assistance in the form of deferred oil payments,” said the report.

“Real benchmark interest rates have increased to around 380bps as of end-December, which will make loan affordability increasingly difficult in the low margin manufacturing sector that has been the main recipient of the recent surge in credit,” it observed.

Moreover, we expect oil prices to rebound over the coming quarters , which will pose headwinds to the economy – our Oil and Gas team forecasts the price of Brent crude oil to average USD75.0/bbl in 2019, up from the spot price of around USD60.70/bbl.

“However, this is not solving the root cause of the problem, which is the country is spending beyond its means.

The continued rise in government bond yields, which hit 10.1% on January 14, partly reflects the rising credit risk,” said the report.