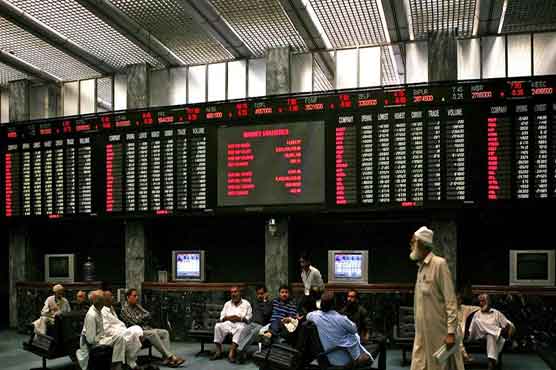

PSX records fresh decline of 299 points, touches 39,303

The market underwent heavy selling pressure and at one time index lost more than 800 points

KARACHI (Dunya News) – The capital market was once again under the command of bears with the index suffer fresh declines under the lead of cement, steel, auto manufacturer, oil and gas exploration on continuous rise in foreign debts and difficulties facing to clear the on-going payments and rumors of changes in the ministry level especially the finance minister.

Salman Ahmad, head of equity sales at Aba Ali Habib said that rise in the benchmark interest, reaching to double digit was the main factor behind slippage in the share values which reached to 10 percent. “The companies with leverage position like cement and steel sector which borrowed in the last two years for expansion have been under threat because of rising interest rate, which would throttle the earnings”, he said.

The market underwent heavy selling pressure and at one time index lost more than 800 points, however, some respite came following the news that Prime Minister Imran Khan would soon visit Karachi and would holds with business community and will be briefed on stock market performance, Salman said.

According to an analyst the market lacked positive developments from the economy side. Once again the rupee depreciated against dollar with a smaller margin but it hints it reach to Rs 140 level one of the conditions of the IMF to acquire loans.

The same analyst said that high cost of borrowing in shape of rising interest rate hitting hard to all the manufacturing units. Moreover rising rupee/dollar parity also impacting companies have foreign exchange leveraged like cement, pharmaceuticals, oil companies, refineries and gas exploring companies.

Another factor which dented the sentiment was continuous talk of change in guards at the ministry of finance. Though Minister for Finance Asad Umar categorically denied the removal of the resignation but the market has been full of rumor that he has resigned or removed and two or three names have been discussed in the corridors of federal capital.

Details by Haris Zamir