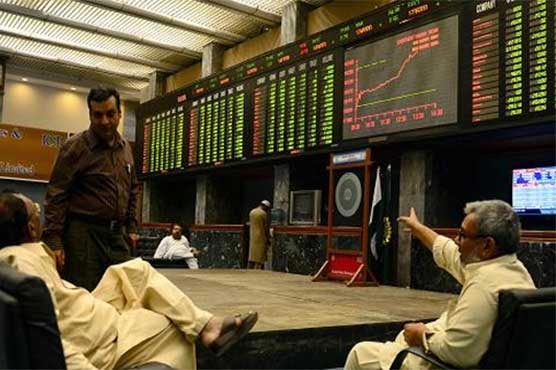

PSX shoots up 1032 points, crosses 42,000 mark

The Index traded in a range of 1197.92 points or 2.90 percent of previous close

KARACHI (Dunya News) – Pakistan Stock Exchange on Thursday witnessed bullish trend as the KSE-100 Index closed today at 42,523.07 points as compared to 41,357.56 points on the last working day with a positive change of 1032 points.

The Index traded in a range of 1197.92 points or 2.90 percent of previous close, showing an intraday high of 42,555.48 and a low of 41,357.56.

Of the 92 traded companies in the KSE100 Index 83 closed up while 9 closed down. Total volume traded for the index was 249.49 million shares.

All Share Volume increased by 82.42 million to 362.49 million Shares. Market Cap increased by Rs173.56 billion.

Total companies traded were 381 compared to 353 from the previous session. Of the scrips traded 325 closed up, 44 closed down while 12 remained unchanged.

Total trades increased by 4,748 to 95,262. Value Traded increased by 2.07 billion to Rs13.77 billion.

On Wednesday, the PSX witnessed bearish trend as the KSE-100 index fell by 546.91 points or 1.32 percent due to geo-political and regional security concerns. The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 41,357.56 points against 41,904.47points showing a decline of 546.91 points.

Of the 92 traded companies in the KSE100 Index 12 closed up 79 closed down, while 1 remained unchanged. Total volume traded for the index was 209.28 million shares.

All Share Volume increased by 73.18 Million to 280.07 Million Shares. Market Cap decreased by Rs87.55 Billion. Total companies traded were 353 compared to 365 from the previous session. Of the scrips traded 42 closed up, 292 closed down while 19 remained unchanged.

Total trades increased by 8,163 to 90,514. Value Traded increased by 2.51 Billion to Rs11.69 Billion.

On Monday, the PSX witnessed a bearish trend as the KSE-100 index fell by 1,027 points or 2.4 percent due to geo-political and regional security concerns.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 41,296.24 points as against 42,323 points showing a decline of 1027 points.

Analysts at Arif Habib Limited said geo-political and regional security concerns took toll on market sentiment and investors resorted to selling.

Of the 93 traded companies in the KSE100 Index 3 closed up while 90 closed down. Total volume traded for the index was 200.00 million shares.

Sector wise, the index was let down by Commercial Banks with 186 points, Fertilizer with 155 points, Cement with 111 points, Oil & Gas Exploration Companies with 92 points and Power Generation & Distribution with 85 points.

On Thursday, Year 2020 had been strongly welcomed by the investors at the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 share Index stormed past 42,000 level, and hit the record high of 42,480.76 points in around 16 months.

The KSE-100 Index closed today at 42,480.76 points with an increase of 1080.76 points or 2.54 percent amid positive sentiments among investors.

Yesterday, the first day of 2020, the KSE-100 Index accumulated massive gains of 664.92 points (1.63 percent) and closed above the 41,000-level at 41,400.

The index had opened at 40,735.08 and did not look back, surging to intraday high by 809 points. It had maintained the rising momentum that started in August last year and after wiping out all the red, provided a return of 10pc.

Investors’ optimism continued as they saw the market back in the green after two earlier dismal years of negative returns. The stocks had edged down on last working day of year 2019.

In the previous week, the stock market witnessed massive fluctuations as it began on a negative note on Monday when the KSE-100 share Index plunged by 824.70 points for profit-taking sessions before Christmas holiday amid absence of positive triggers but later on Thursday gained 799.47 points amid positive sentiments among traders.

The index was last seen trading above 41,000 points in February, 2019. So far, the market has regained over 11,000 points after hitting a five-year low at 28,671 points in August 2019.

Major developments earlier were, firstly, inflow of $1.3 billion from Asian Development Bank (ADB) for budgetary support and to address power sector reforms, secondly, worker remittances during November which stood at $1.8 billion (up 9.4 percent as compared to the same month last year), thirdly, forex reserves reaching $16 billion, up by 0.4 percent on a weekly basis, excluding tranche received from ADB, and fourthly, the latest PIB auction that saw 10-yr PIB cut off below 11 per cent that was last seen in Oct.18.

Improvement on the external front together with stability in the Pakistani Rupee was expected to reassure foreign investors.

Meanwhile, inflationary readings are set to touch peak in January 2020 (this month) with an imminent interest rate cut to follow, domestic investors remain jubilant as well, he said.