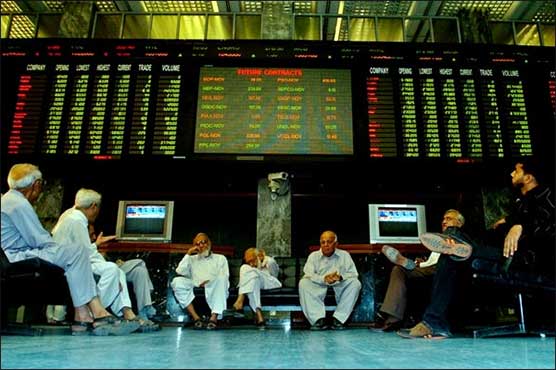

Weekly review: PSX closed at 34476 points, almost four months high mark

PSX recorded a gain of 4.4% or 1442 points during outgoing week.

KARACHI (Haris Zamir) - Pakistan Stock Exchange closed on positive note for the second consecutive week with the KSE-100 index finishing at four month high mark on expectation that benchmark interest rate likely to see some reversion following sharp cut in short term government securities i.e. treasury bills.

Rising for the second consecutive week, stock market 100 index gained 4.37 percent or 1442 points to 34475 points. The closing above 34000 points arrived after almost four months, on July 4, 2019 the index finished at 34570 points.

Samiullah Tariq director research at Arif Habib said that the market has increased by 19.8 percent from its low of 28,765 points touched on August 16, 2019 and has reached 34,475 points.

Market participation has broadened as volumes increased to 287 million on Friday compared to 65 million on August 16, 2019. The value traded of Rs 10.6 billion was highest for 2019 compared with Rs 3.4 billion traded on August 16, 2019. Average volume for Oct-19 is 263 million shares, which is the highest since May 2017 (when PSX was included in MSCI EM index).

Based on NCCPL data, foreigners remained net sellers amounting to $4.7 million. On the local’s side, Individuals were net buyer of $4.36 million, while Banks and insurance were net sellers of $4.13 million and $4.75 million respectively.

This week trading commenced on positive note attributable to Asia Pacific Group’s report on money laundering in which Pakistan was found partially compliant on majority of the issues which improved investors’ confidence. On the other hand, Prime Minister Imran Khan’s successful visit to China in which they expressed satisfaction on CPEC progress further improved overall sentiment.

An analyst from BMA Capital Management said that recent movement in secondary market yields has been building up market expectations for an interest rate cut in the Monetary Policy Committee (MPC) announcement scheduled for Nov’19. Moreover, the result season is expected to kick off from next week.

"We expect improvement in earnings from Banks, E&Ps, Power, and Chemicals to drive investor’s sentiments. On the other hand, results of cement, steel and auto sector along with upcoming FATF review may also play a vital role in determining the trajectory of the market."