Rs1,700 billion tax is to be collected in Q4: SBP report

FBR tax collection at the end of third quarter stood at 61.4 percent of the annual target.

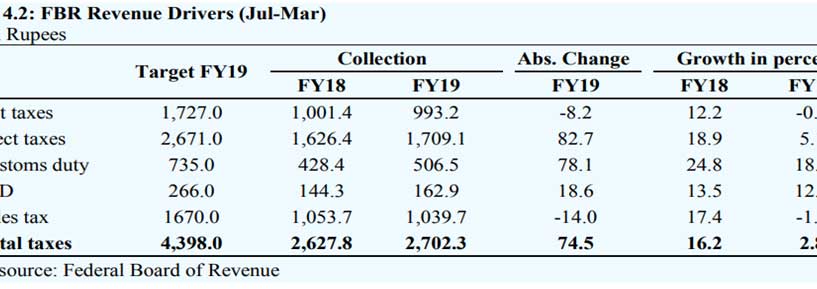

KARACHI (Web Desk) - FBR tax collection grew only by 2.8 percent during Jul-Mar FY19 as compared to a double-digit growth of 16.2 percent during the same period last year, the State Bank of Pakistan reported in its Third Quarterly Report 2018-19.

"A decline in sales tax and direct taxes (particularly withholding taxes) along with a deceleration in customs duty and FED explained the overall slowdown of FBR tax collection. FBR tax collection at the end of third quarter stood at 61.4 percent of the annual target, which leaves around 38.6 percent for the last quarter. In absolute terms, almost Rs 1,700 billion is to be collected in Q4; keeping in view the historical trend, achieving the target seems challenging," the SBP stated.

Decline in direct taxes owing to some policy measures

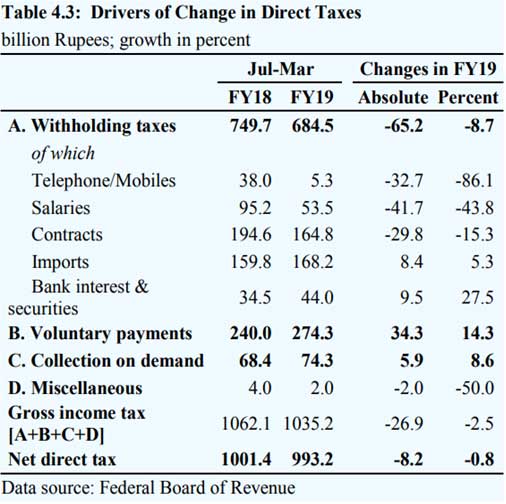

Direct taxes having a share of 37.0 percent in overall FBR tax collection recorded a decline of 0.8 percent during Jul-Mar FY19 in contrast to a rise of 12.2 percent during the same period last year.

Measures like the suspension of tax on mobile top-ups; reduction in come tax rates on salaries; reduction in the withholding tax rate on dividends; and spending under the PSDP explain the decline in direct taxes.

Within direct taxes, major hit emerged from withholding taxes (largest contributor in direct taxes), which recorded a contraction of 8.7 percent during Jul-Mar FY19 against a rise of 16.1 percent during the same period last year. Onehalf of the decline in total withholding taxes is in the category of telephone/mobiles.

Collection from telephone was only Rs 5.3 billion during JulMar FY19 compared to a collection of Rs 38.0 billion during the same period last year. This lower collection from telephone/mobile phones was not surprising amid suspension of taxes on mobile phone top-up by the Supreme Court.

Tax collection on salaries also remained much lower than last year. In absolute terms, tax on salaries declined by Rs 41.7 billion during the review period, mainly due to changes in income tax rates for all income slabs. Receipts from contracts were also lower compared to last year largely owing to a cut in the PSDP.

Voluntary payments increased by Rs 34.3 billion during Jul-Mar FY19. It is important to mention that during FY18, voluntary payments remained much lower than its average.6 Collection on demand increased by Rs 5.9 billion compared to an increase of Rs 8.8 billion during the same period last year.

This marginal deceleration is apparently an outcome of extension in the deadline for e-filing of tax returns in FY19. In practice, the deadline is usually within the second quarter of the fiscal year; however, in FY19, the deadline was extended beyond Q3-FY19.

Lower Collection of Indirect Taxes as Industrial Sector Faced Slowdown

As compared to a growth of 18.9 percent during Jul-Mar FY18, the indirect taxes grew only by 5.1 percent during JulMar FY19. Disaggregated analysis of indirect taxes show a contraction of 1.3 percent in sales tax during Jul-Mar FY19 in contrast to a growth of 17.4 percent during the same period last year. Both categories of sales tax, i.e. domestic and import, recorded a negative growth. Lower industrial growth, moderation in overall economic activity and subdued import demand contributed to this decline.

Within sales tax, major fall was in the category of petroleum products. Lower tax rates on various petroleum products and lower import quantum during Jul-Mar FY19 were the primary reasons of the decline in tax collection. Similarly, sales tax collection on iron & steel products declined amid contained domestic demand & lower import quantum during the period under analysis. Sales tax collection from cement also recorded a fall because of lower sales volume.

Custom and excise duty collections record double-digit growth

The depreciation of PKR, imposition of regulatory duty, and an increase in excise duties led to a double-digit growth in custom and excise collection during Jul-Mar FY19.

FED and customs duty recorded a YoY growth of 12.9 and 18.2 percent respectively during Jul-Mar FY19. As highlighted in the second quarterly report for FY19, though there was a slowdown in the quantum of imports, the PKR depreciation mainly helped maintain the overall growth in value terms.

With the exception of vehicles, custom collection on other major categories i.e. iron & steel, and electrical machinery & equipment increased significantly during the period under review.